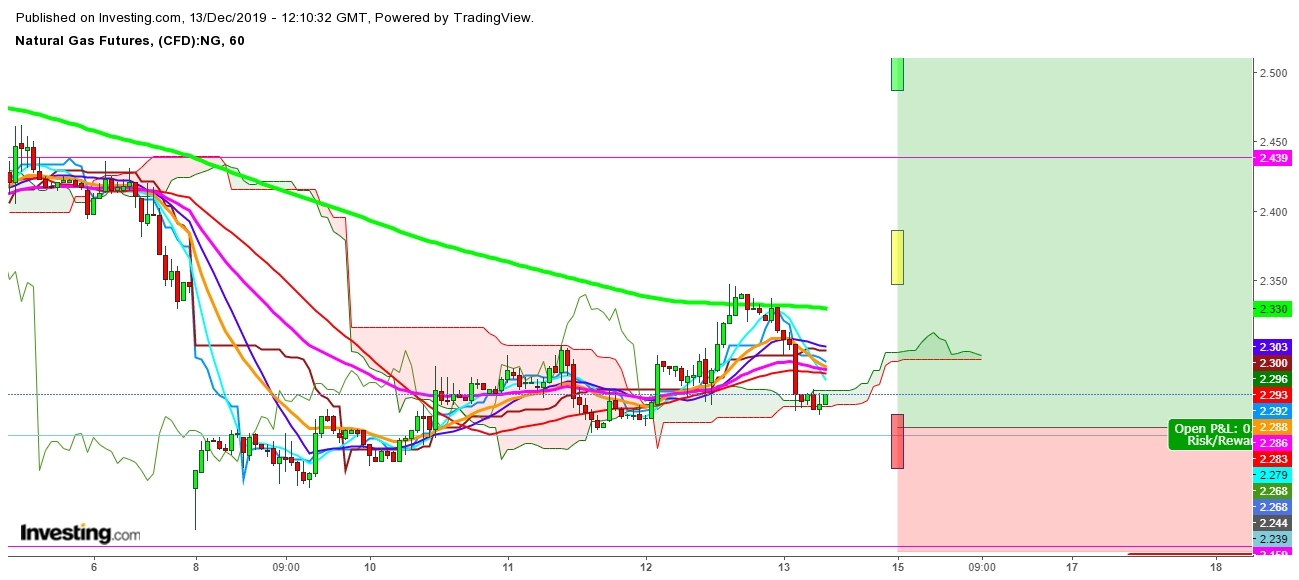

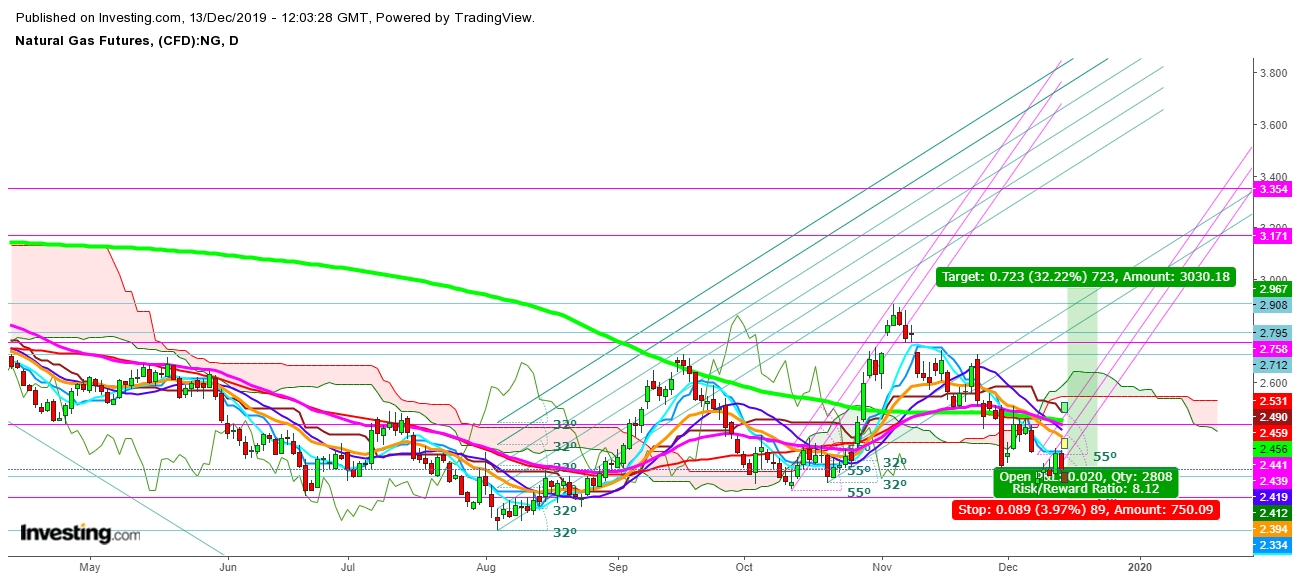

On analysis of the movements of Natural Gas futures, in different time frames, I find that the bears have shown their strength since yesterday's inventory announcement; despited the fact that the announcement of withdrawal of 73 Bcf on December 12th, 2019 was much more than last week. I find that the short-covering rally may be seen in Natural Gas futures before weekly closing, which may mean Natural Gas futures see a weekly closing above $2.548.

I find that the Natural Gas bears would prefer to avoid to be trapped on the last trading day of the week; as the changing weather pattern may attract Natural Gas bulls to become aggressive any time with supporting news flow on week end. According to AccuWeather reports, "A southerly storm track will lead to a stronger system with increased moisture from the Gulf. This would produce stronger thunderstorms as the cold front sweeps through eastern Arkansas, Mississippi, western Tennessee and into western Alabama"; which may tend to a gap-up opening of Natural Gas futures on the first trading session of the upcoming week.

Finally, I conclude that the Natural Gas futures may continue to see higher volatility; but the overall trend will remain upward during the upcoming weeks.

Disclaimer:

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.