Goldman gives "buy" rating to Nvidia, citing signs of early AI monetization

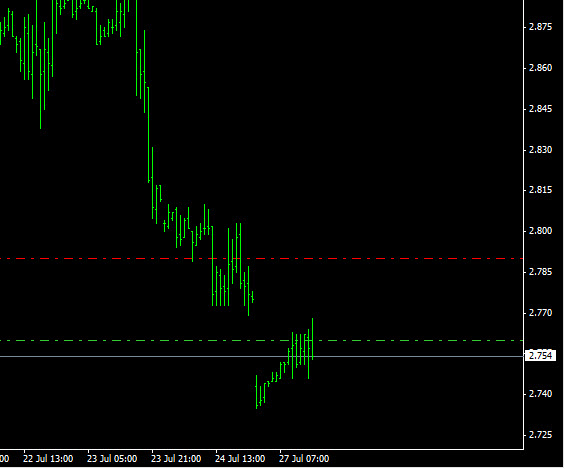

The natural gas markets started out the week by gapping lower. This course extends the bearish pressure in this market, as we have seen a lot of people make a lot of money by selling. The simple reality is that supply in the natural gas markets is simply far too strong for market forces to soak up. Supply will continue to outlast the man, and therefore we don’t even have a scenario in which we buy natural gas.

We have come back to fill that gap, and are starting to fall at this point in time. We have chosen to trade this market via CFDs, as it allows for better position sizing. With this, we are already short as you can see, as a classic “fill the gap” situation has arisen, and now we are starting to try to roll over again.

Even if this trade fails, we can keep a fairly tight stop, as we know that if the gap gets filled and we continue to go higher, that is quite often a sign of bullishness. With this, we think the risk to reward ratio is simply too strong to ignore, and have started the week out selling natural gas yet again. We believe that the market could very easily reach the $2.65 level given enough time, but we do recognize that this market tends to be very volatile, and therefore difficult for some traders to handle.

If we do break to the upside at this point in time, we will simply look to sell at higher levels. We believe that there is plenty of resistance near the $2.81 level as well, and would be interested in selling resistive candles in that area as well.