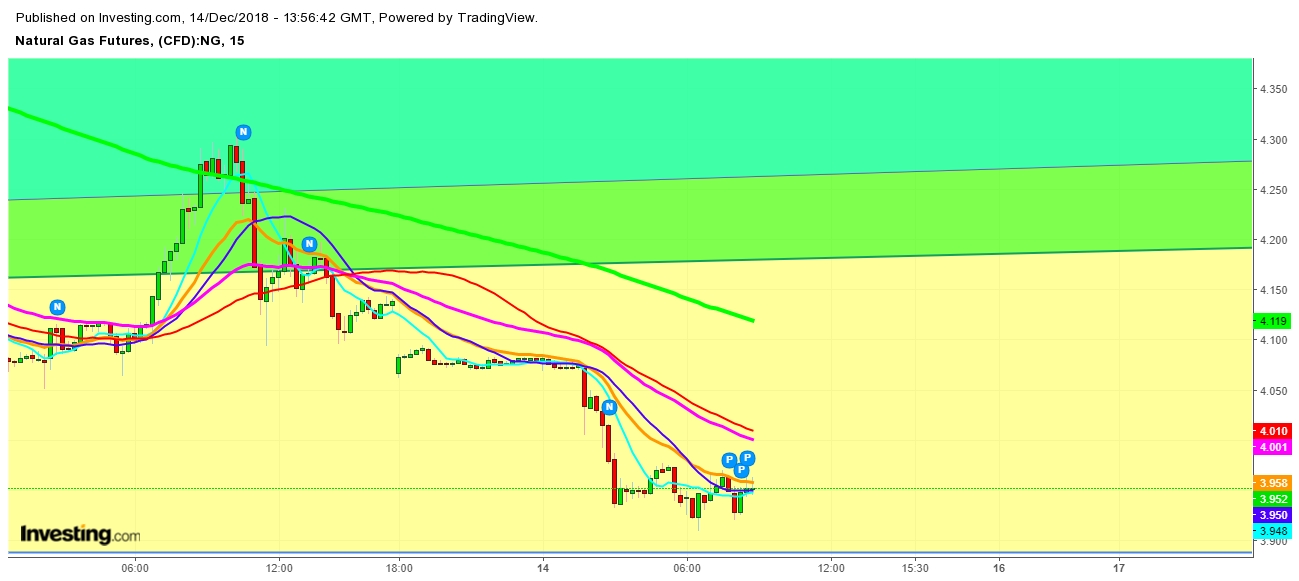

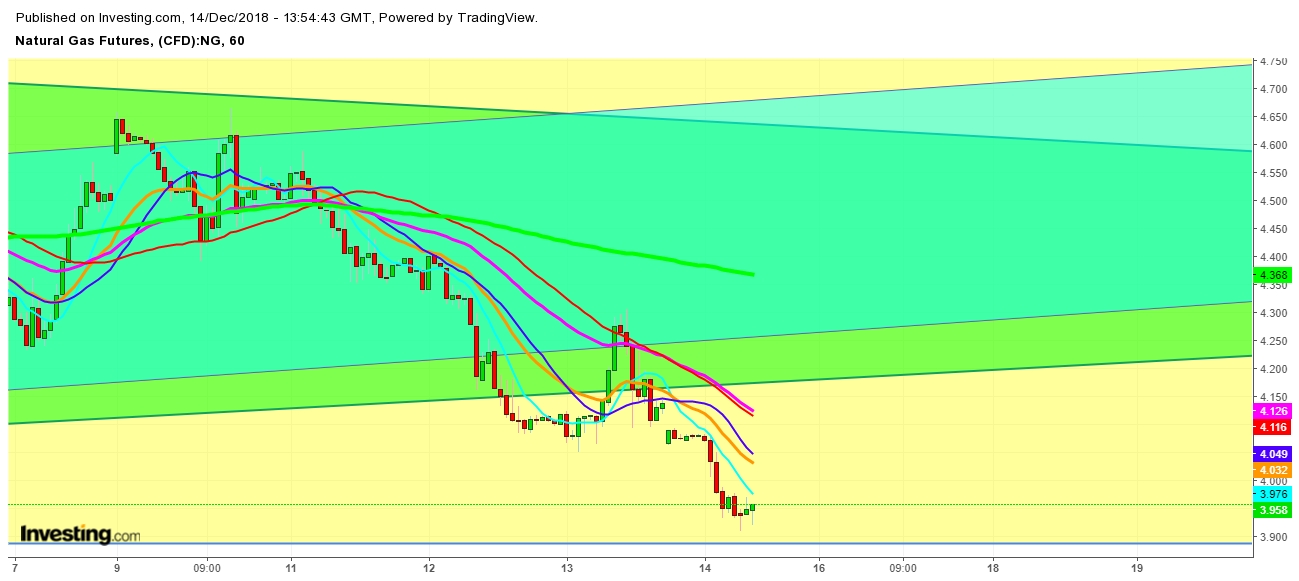

Since my last analysis, Natural Gas has bounced back up to $4.308, yet it could not sustain there for long and started to move downward. Natural Gas futures have reached the buying territory and look ready to see a weekly close above $4.156. No doubt that the current level will attract dip buyers while winter kicks in to provide a good boost to natural gas futures and spot prices. Due to the expected heating demand in the coming weeks, I find that Natural Gas seen sufficient buying from Natural Gas dip buyers, which are present in thick numbers at the current levels and is likely to attract more bulls til the weekly closing. A weekly closing above $4.157 will confirm a good gap-up opening on the first trading session of the upcoming week. Let’s have a look at the movements of Natural Gas futures in the following charts.

Disclaimer: This analysis is only for educational purpose. Readers are requested to kindly consider their own view first, before taking any position.