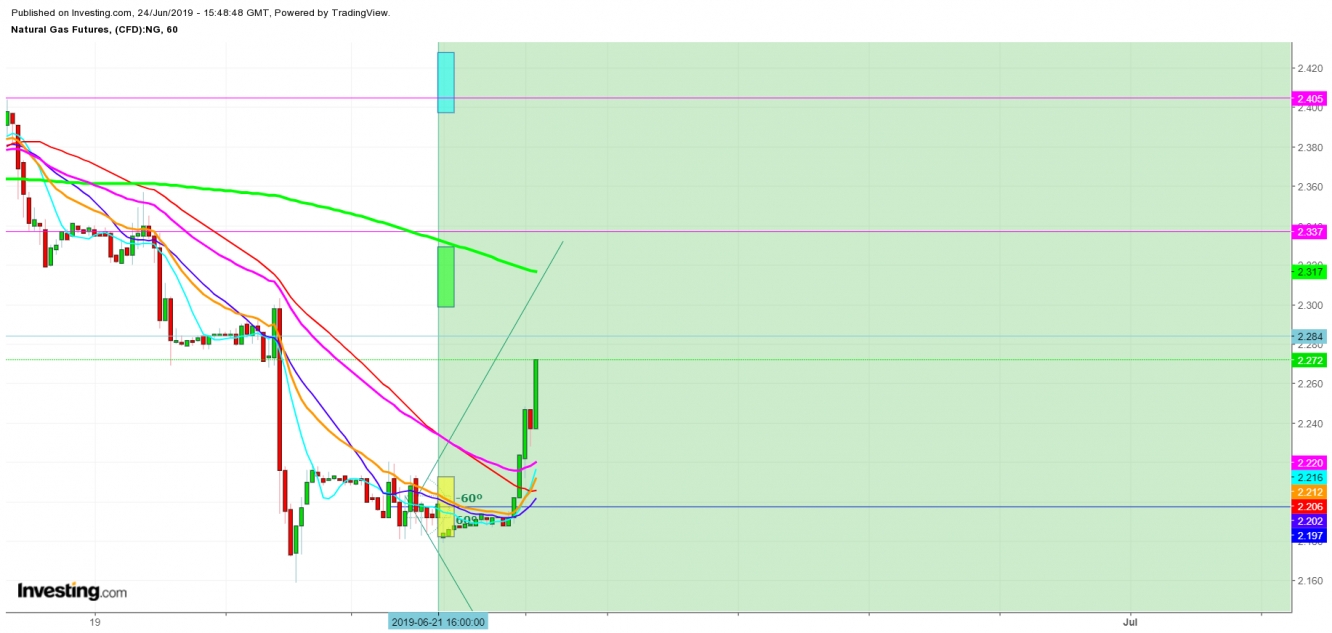

On analysis of the movements of Natural Gas futures, I find that it looks ready to take a steep upward move, before Presidents Donald Trump and Xi Jinping make a successful deal to end tariff trade war on June 28-29, 2019. I find that the side-line meetings during G 20 summit for fixing the final meet between both presidents have enhanced hopes amid natural gas traders for a positive outcome.

A successful deal on the tariff trade-war front will negate the over-supply issue of Natural Gas due to diversion of a good chunk of US Natural Gas to China; where growing efforts to promote the use of more and more Natural Gas to keep the environment clean are evident enough for growing demand for Natural Gas during the upcoming weeks for industrial and domestic use.

Watch my video on Natural Gas below.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.