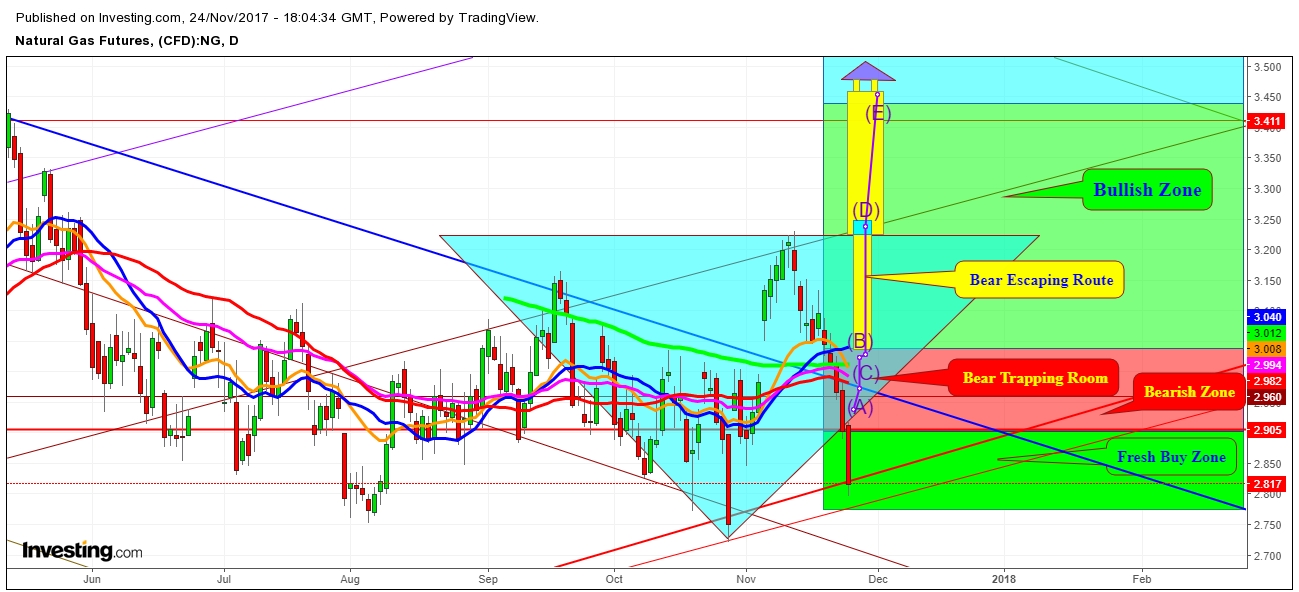

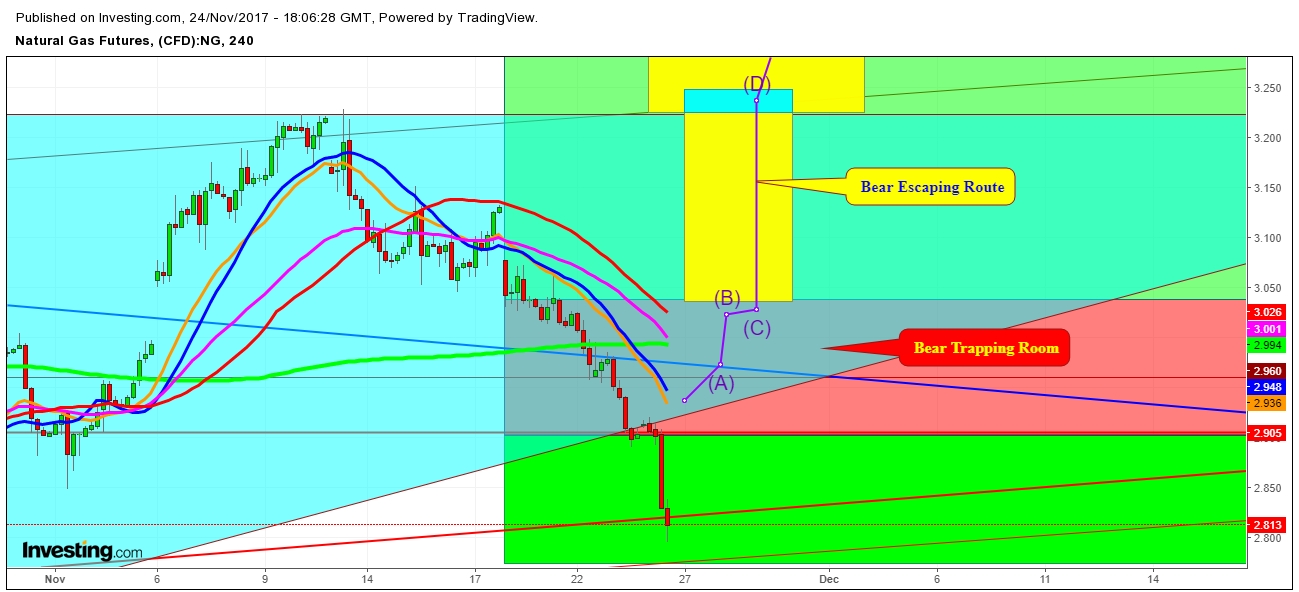

On analysis of the movement of Natural Gas futures price in the same chart pattern which I noted in my last analysis, I find that although,the bears have tried their best to drill a hole in the ground on the last trading session of the Week on November 24th, 2017 but remained unsuccessful.

And, now they have no option after being trapped inside a tight compartment in large numbers, except running upward towards the ventilation hole in the roof for breathing fresh air. I define the expected escaping route for the bears to reach up to the ventilation hole before the advent of winter, and before the heating demand start growing like wild fire. Weekly injections have turned into withdrawals, which are definitely a warning signals for bears to use empty chimney as a good way to come out on the roof, otherwise they would have no choice.

I find a sustainable move above $2.947 on November 27th, 2017 will confirm the Natural Gas bears’ retreating march to adopt the best option for their safe retrieval.

Disclosure: This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI