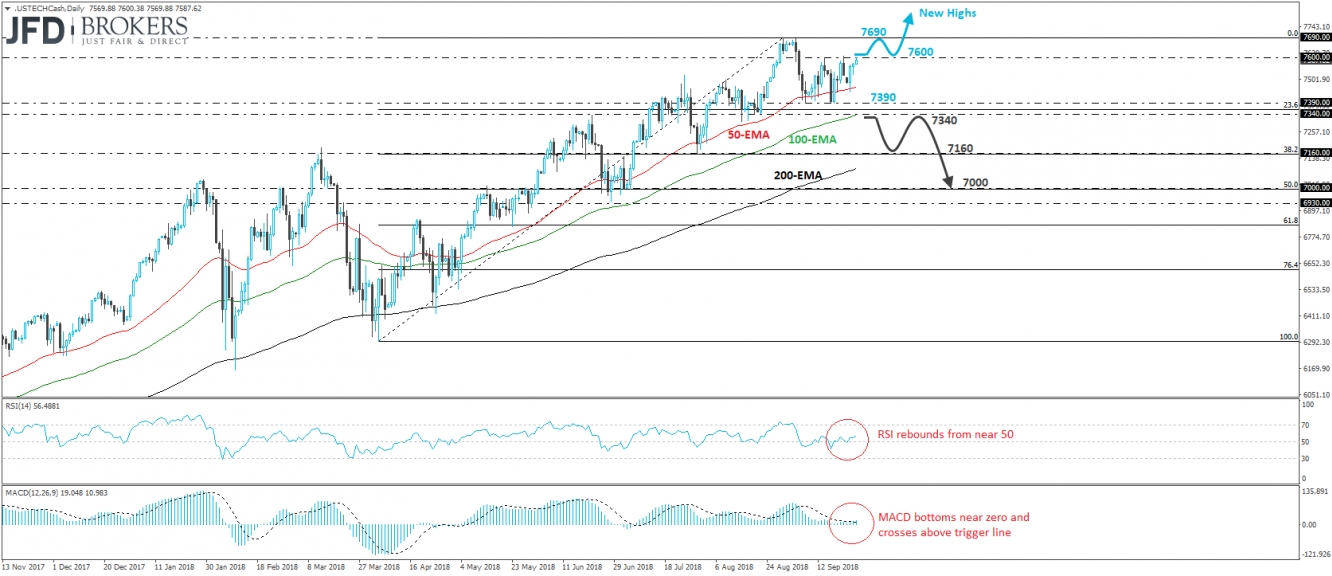

The NASDAQ 100 cash index has been trading in the green this week. However, after it pulled back from near its record high in the beginning of September, the price structure suggests a short-term range slightly above the 23.6% Fibonacci retracement level of the 4th of April – 4th of September uptrend. Although this keeps the short-term picture somewhat flat, given that the index remains above all three of our moving averages, we would consider the medium-term outlook to be positive.

A break above the upper bound of the aforementioned range, at 7600, could pave the way for another test near the index’s all-time high of around 7690, but we would like to see a clear close above that level before we get confident on larger bullish extensions. Something like that would confirm a forthcoming higher high and would drive the index into unchartered territories. This may encourage the bulls to put the psychological zone of 8000 on their radars.

Looking at our daily momentum indicators, we see that the RSI rebounded from near its 50 line and is now pointing up, while the MACD has bottomed near zero and crossed above its trigger line. These indicators support the notion for the index to trade north for a while more, at least for another test near its record peak.

On the downside, we would like to see a clear dip below 7340 before we start examining the potential of a deeper bearish correction. Such a move could confirm the break of the 23.6% Fibo zone and is possible to initially aim for the 7160 barrier, marked by the low of the 30th of July, which also coincides with the 38.2% retracement level of the prevailing uptrend. Another dip below 7160 could set stage for the psychological hurdle of 7000, which matches with the 50% Fibonacci retracement level.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.