In my article from two weeks ago, I showed the NASDAQ 100 bulls had one more chance if the early-March NDX 12208 low held. The rally since then to13297 by mid-March was constructive, but the subsequent decline we are now dealing with leaves much to be desired and has opened up Pandora (OTC:PANDY)'s box: the NDX and its related ETF, the Invesco QQQ Trust (NASDAQ:QQQ), has a YTD return of -1.5%. Not the best of first quarter.

In this update, I will share with you the four Elliott Wave Principle (EWP) options I am tracking. One is highly bearish, others are short-term bearish, but then intermediate-term bullish. Ultimately, all are still long-term (months out) bearish. Allow me to explain, as this will be an exercise in understanding the probabilities of possibilities. Namely, the financial markets are probabilistic, and the EWP helps in understanding these options. It can tell when critical price levels are broken to the upside or downside, which of these options are invalidated. One by one, there will then only be "one-man-standing," so to say.

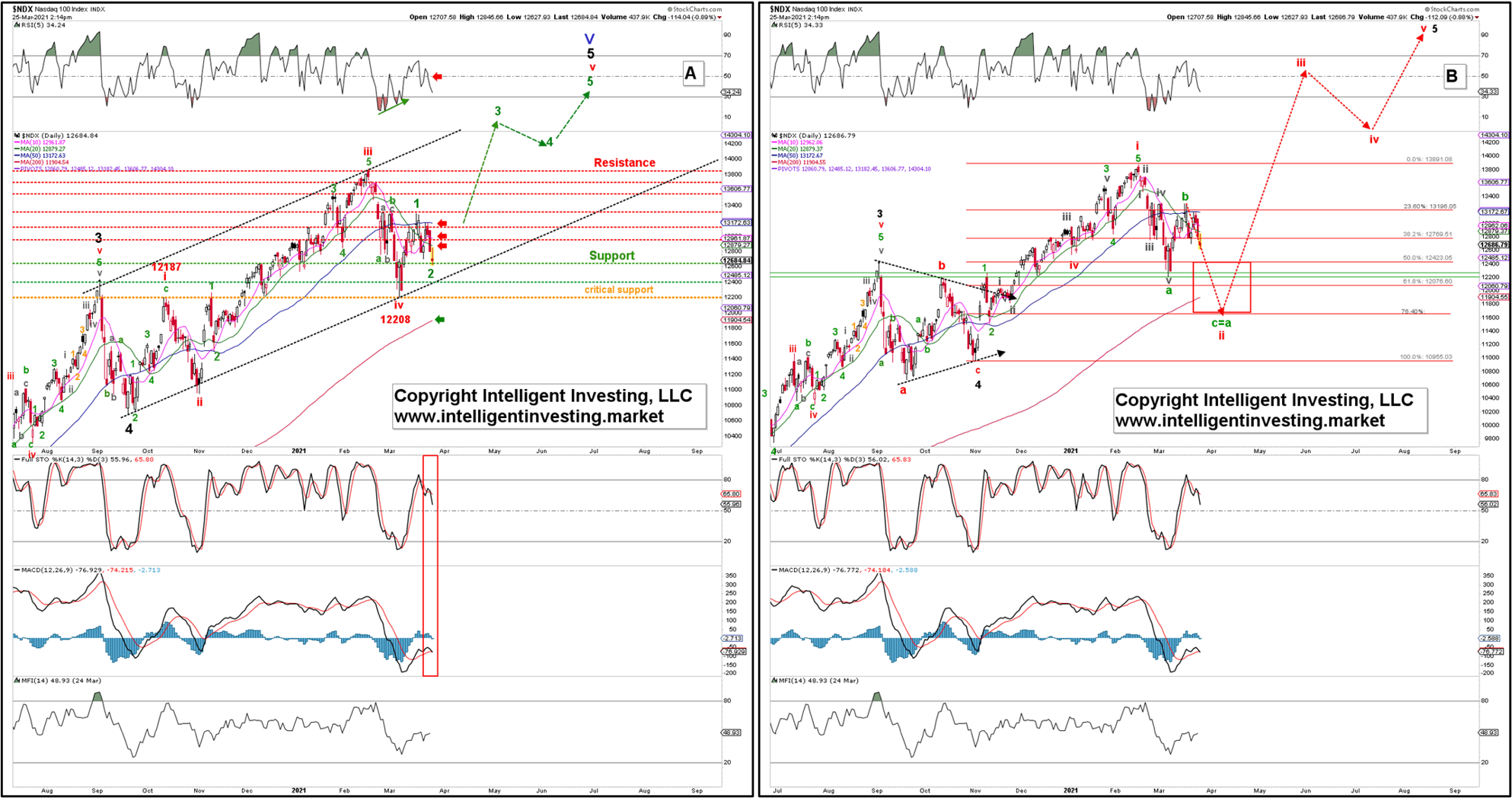

Figure 1 A, B. NDX 100 daily candlestick chart with EWP count and technical indicators.

Figure 1 above shows two EWP options. The first (A) is, per my previous update's option and (red) intermediate wave-iv bottomed March 5 at NDX 12208, and red wave-v is now underway, currently subdividing into a (green) minor-1 and 2. As long as that low holds, this is possible. We need to see a move above the minor-1 high soon to confirm this option. Conversely, a close below today's low targets the next support at NDX 12400. This would increase the possibility of the second option shown in Figure 1B.

(B) The current decline is (red) wave-ii of a large (black) major wave-5. The ideal (green) c=a targets almost exactly the 76.40% retrace of the prior red wave-i, i.e., the October-February rally. A 76.40% retrace is not uncommon for a second wave, and once complete, wave-iii, iv, and v are yet to come (red dotted arrows), targeting well into the NDX 17000s. Please note the difference in where (black) major-4 was between Figure 1A and B. In the latter case, wave-4 was a more complex triangle instead of a simple zigzag. This brings me to Figure 2 below.

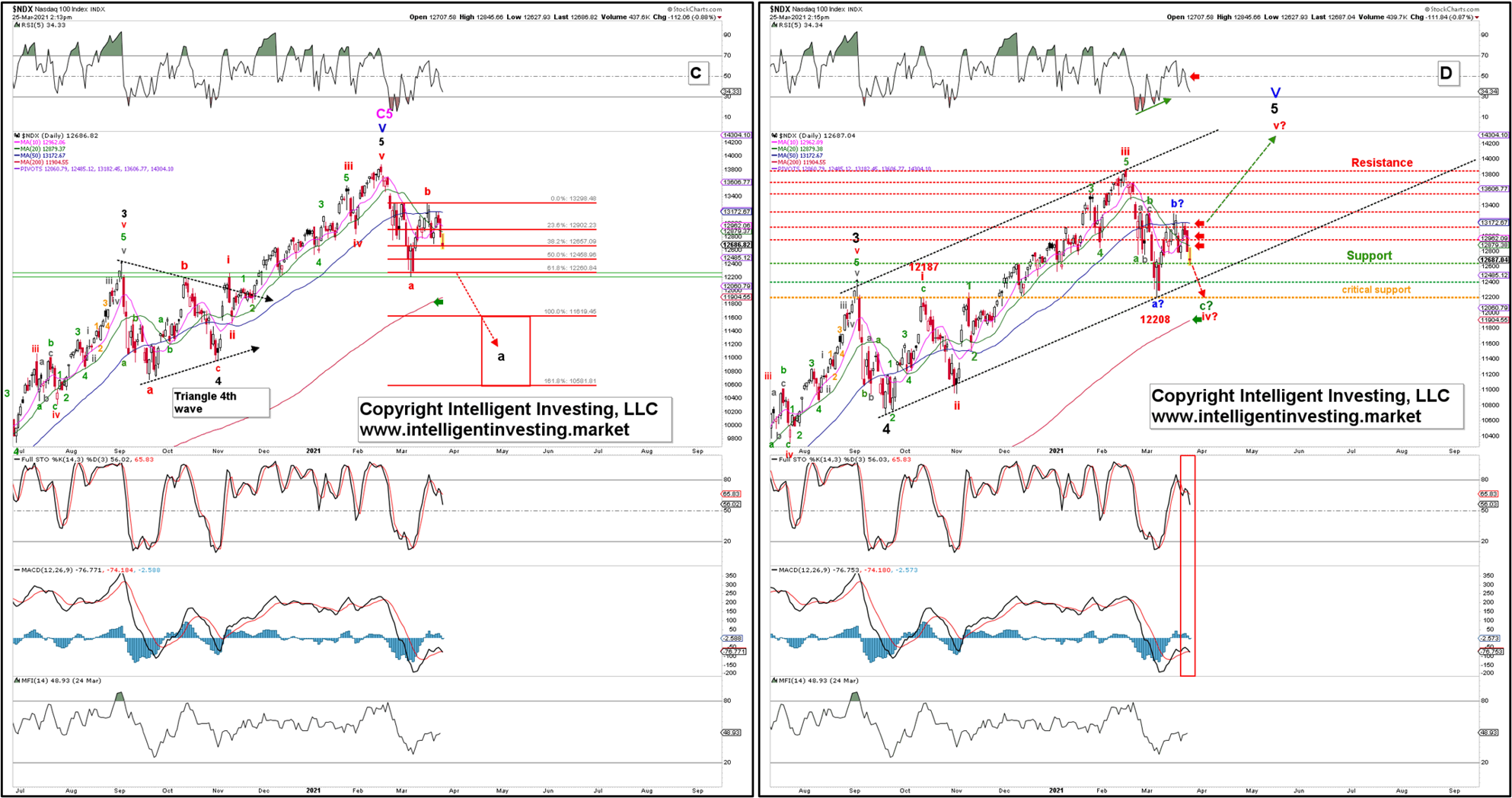

Figure 2 C, D. NDX100 daily candlestick chart with EWP count and technical indicators.

Figure 2C is the most bearish alternative. The February top is a complete impulse going first back to the late-October 2020 low, then the March 2020 low, then the March 2009 low, and even the 1932 low. After a 90-year bull market, it is not far-fetched to assume the party is over. A close below that 76.40% retrace (NDX 11648 to be exact) increases the odds of this EWP potential because second waves often do not retrace that much of the initial first wave. It is technically still possible, but less likely. Thus, the probabilities then start to shift to the EWP options shown here in Figure 2C. The EWP option from Figure 1B is by then long gone. See how one can check them off one-by-one using this elegant, simple technique? In this case, I expect the NDX to bottom in the red target zone, 10580-11620, depending on the length of the c-wave the market is then in, to complete black wave-a.

Lastly, the "happy" middle-of-the-road option is shown in Figure 2D. The NDX will retest the 12200 level one more time to complete a complex (red) intermediate wave-iv, with (green) minor-c now underway. It will take option A off the table soon, but obviously, the index cannot move below the intermediate-wave-i high (NDX 12187), or it will shift us to either option B or C. Why? Because in an impulse move, the first wave high and fourth wave low are not allowed to overlap. This is only permitted in a diagonal (see here), but I would not bank on such a price structure because there are not many hard rules that govern them and, thus, they are very unreliable.

Bottom line: The NDX is currently at a crossroads. It will choose its path eventually, as markets always know where they have been, are and will be, but it is up to analysts to figure out the latter part. Sometimes that is easier than other times. Right now, the index's future outlook is muddled, but it will show us its hands sooner than later by a subsequent breakout or breakdown above or below critical price levels. And when it does, we have our road maps ready.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI