While the pathway to commercial shipments is taking longer than anticipated, we now have better visibility that an inflection is set to happen. The first Nanoco Group Plc (LON:NANON) displays are due for public launch this Christmas season. The first low volume shipments of Nano-materials to the company’s tier one US sensor partner are set to start in Q4 CY18. Successful stress testing of the new facility at Runcorn in H1 CY19 should pave the way for volume production, now anticipated for H2 CY19.

Moving towards volume sales in sensors and display

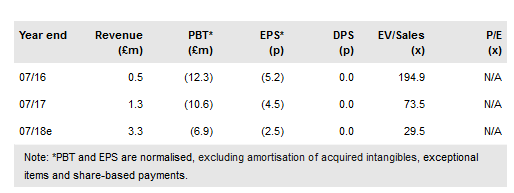

Nanoco’s trading update confirms the design, build and commissioning of manufacturing facilities in Runcorn to support manufacture of nanomaterials for the company’s tier one US partner is progressing as planned. Small-scale shipments are expected to start in Q4 CY18, but complexities elsewhere in the supply chain mean volume shipments are now anticipated to start in H2 CY19 vs H1 previously. The doubling of manufacturing capacity at the Runcorn site to support the first agreement indicates the potential from this partnership is significant. The company did not reach commercial volume shipments in display in FY18, but we now have visibility of the first commercial shipments, with gaming monitors (manufactured by a Taiwanese display maker, using Wah Hong film) expected to ship for the FY18 festive season. While the high-end computer display market has the potential to generate useful incremental revenues, successfully penetrating the mid- to high-end TV market remains key to driving a significant inflection from this application.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.