We had quite a roller coaster ride last week in the USD/CAD with another rejection at 1.3320 and a push lower towards 1.30 soon after the announcement by the FED regarding the funds rate being held the same and postponing a rate hike. Technically the USD/CAD has reached the top boundary of the Daily Ichimoku cloud support as shown in the chart below.

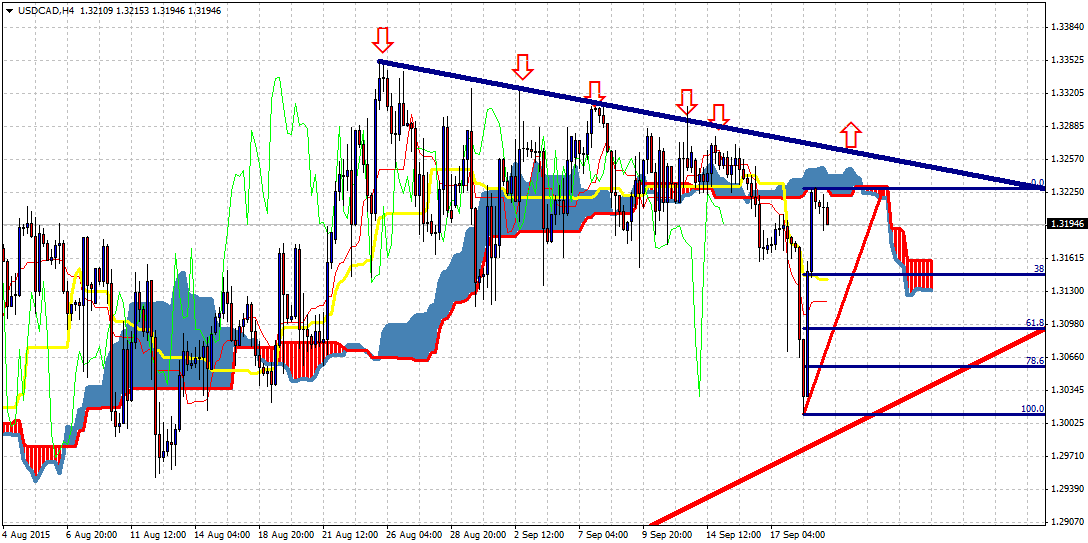

USD/CAD reached the Ichimoku cloud in the 4 hour chart as show below and we get some rejection signals. A rejection here could push price back towards the 38% or 61.8% Fibonacci retracement and that is why I took the decision to close my long position early today.

Position was closed at 1.3193. I will be looking to go long again if price pulls back towards the 61.8% Fibonacci retracement or if price manages to break above the blue downward sloping trend line resistance that was the cause for so many price rejections and bearish reversals.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI