Novo Nordisk cuts full-year sales and profit guidance, stock plunges

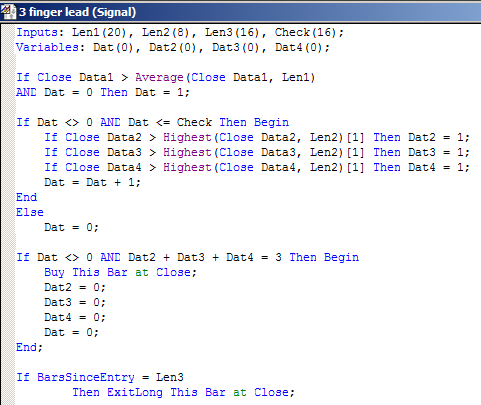

A few years ago I published a series of TradeStation systems which I called the BZB Dirty Dozen. I have revived, modified and merged one of those studies with the signal engine that drives Mosaic.This post reflects the long biased side of the equation and uses the fundamentals of DOW theory to help identify the most opportune times to increase capital exposure. Extensive research has led me to the conclude that when QQQ and XLF are in sync upslope then SPY will continue to follow (and rise). We use DIA simply as a confirmation of momentum.This is really just another example of a “follow the leaders” approach and, like Mosaic, uses no chart analysis and only the most fundamental indicators. 3 Finger Lead trades Long only since our goal is to verify other Mosaic signals like the MM spread (posted yesterday) to guide our capital deployment. TS code language is below:Unlike the larger Mosaic model this system will book short term profits, with an average hold time of 13 days.

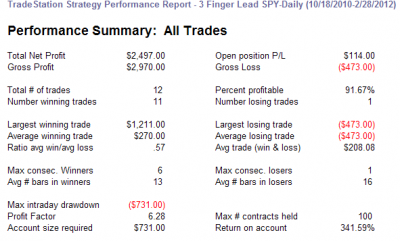

As usual, a critical metric I want to review is the max consecutive losers and in this system that value is 1, as good as it gets. We use the typical 16 month rolling lookback and during that time the system found 12 trades, about 1 every 5 weeks. The system is a slow mover that seeks to accumulate incremental gains and then move on.Below is the actual TradeStation code for 3 Finger Lead in 2000i format.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.