Thirteen months ago, in the aftermath of the debt-ceiling fiasco, which we now know was a last-minute compromise achieved almost entirely thanks to the market plunging to 2011 lows, S&P had the guts to downgrade the U.S. while Moody's didn't. Now, it's Moody's turn to fire up the threat cannon with a release that should the inevitable come to pass, i.e. congressional negotiations do not "lead to specific policies that produce a stabilization and then downward trend in the ratio of federal debt to GDP over the medium term" then "Moody's would expect to lower the rating, probably to Aa1", or a one-notch cut.

Of course, that U.S. GDP has risen by about 8% since last August's fiasco has now been apparently forgotten by both S&P and Moody's. Sadly, continued deterioration in the U.S. credit profile is inevitable, as every single aspect of modern day life that is 'better than its was four years ago' has been borrowed from the future. More importantly, with the S&P at multi-year highs courtesy of Bernanke using monetary policy to replace the need for fiscal policy, Congress will see no need to act and Moody's warning will be completely ignored. That will continue, of course, until it can't.

From Moody's:

Budget negotiations during the 2013 Congressional legislative session will likely determine the direction of the US government's Aaa rating and negative outlook, says Moody's Investors Service in the report "Update of the Outlook for the US Government Debt Rating."

If those negotiations fail to produce such policies, however, Moody's would expect to lower the rating, probably to Aa1.

Maintenance Unlikely

Moody's views the maintenance of the Aaa with a negative outlook into 2014 as unlikely. The only scenario that would likely lead to its temporary maintenance would be if the method adopted to achieve debt stabilization involved a large, immediate fiscal shock -- such as would occur if the so-called "fiscal cliff" actually materialized -- which could lead to instability. Moody's would then need evidence that the economy could rebound from the shock before it would consider returning to a stable outlook.

Moody's notes that it is difficult to predict when during 2013 Congress will conclude negotiations that result in a budget package. The Aaa rating, with its negative outlook, is likely to be maintained until the outcome of those negotiations becomes clear.

Some Kind Of Settlement Seen

The rating outlook also assumes a relatively orderly process for the increase in the statutory debt limit, says Moody's. The debt limit will likely be reached around the end of this year, and the government's ability to meet interest and other expenses out of available resources would likely be exhausted within a few months after the limit is reached.

Under these circumstances, the government's rating would likely be placed under review after the debt limit is reached but several weeks before the exhaustion of the Treasury's resources. Moody's took a similar action during the summer of 2011.

Here's Where We Stand

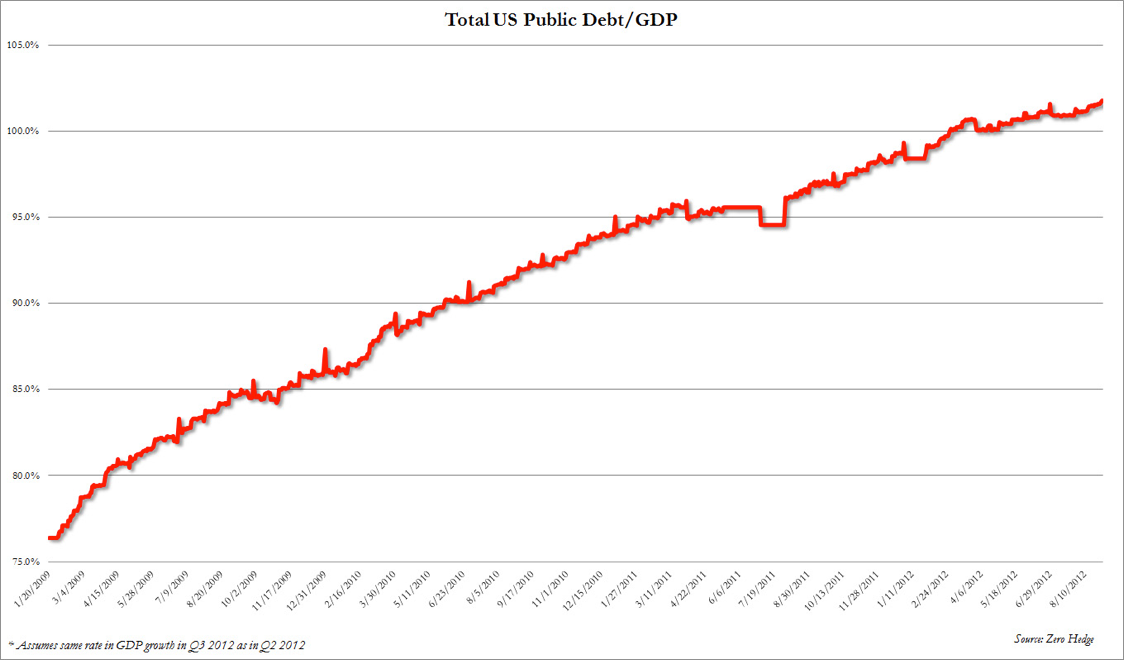

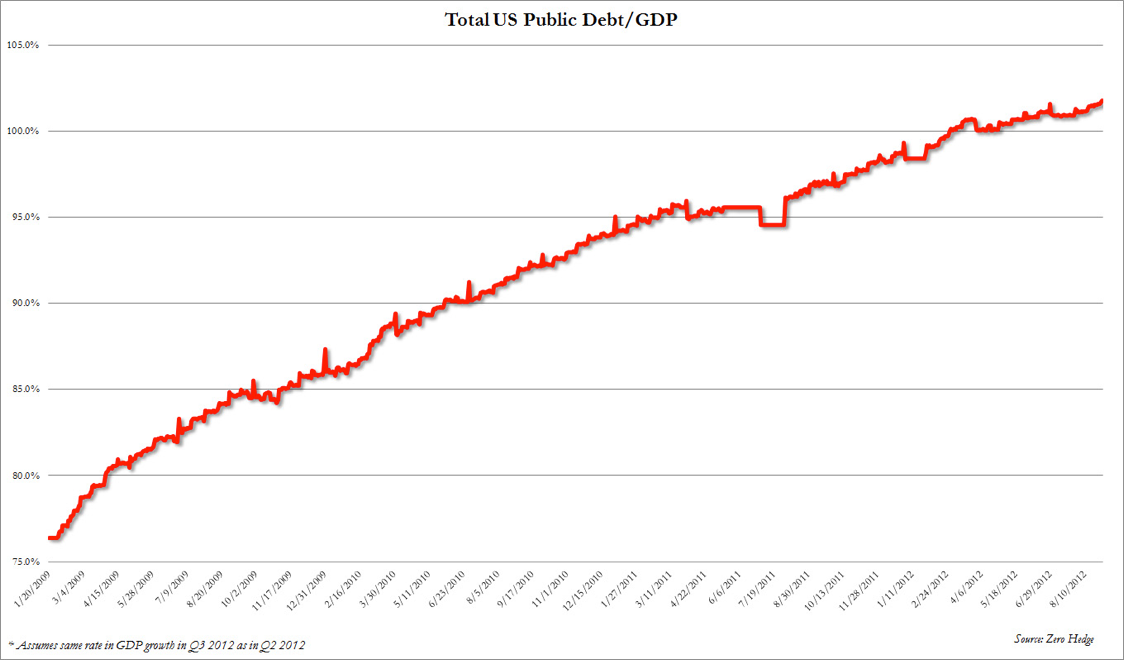

Moody's has basically said that unless the red line stops going from the lower left to the upper right, it may -- just may -- do something.

Courtesy Tyler Durden, founder of ZeorHedge.

The views and opinions expressed herein are the author's own, and do not necessarily reflect those of EconMatter.

Of course, that U.S. GDP has risen by about 8% since last August's fiasco has now been apparently forgotten by both S&P and Moody's. Sadly, continued deterioration in the U.S. credit profile is inevitable, as every single aspect of modern day life that is 'better than its was four years ago' has been borrowed from the future. More importantly, with the S&P at multi-year highs courtesy of Bernanke using monetary policy to replace the need for fiscal policy, Congress will see no need to act and Moody's warning will be completely ignored. That will continue, of course, until it can't.

From Moody's:

Budget negotiations during the 2013 Congressional legislative session will likely determine the direction of the US government's Aaa rating and negative outlook, says Moody's Investors Service in the report "Update of the Outlook for the US Government Debt Rating."

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

If those negotiations lead to specific policies that produce a stabilization and then a downward trend in the ratio of federal debt to GDP over the medium term, the rating will likely be affirmed and the outlook returned to stable, says Moody's.If those negotiations fail to produce such policies, however, Moody's would expect to lower the rating, probably to Aa1.

Maintenance Unlikely

Moody's views the maintenance of the Aaa with a negative outlook into 2014 as unlikely. The only scenario that would likely lead to its temporary maintenance would be if the method adopted to achieve debt stabilization involved a large, immediate fiscal shock -- such as would occur if the so-called "fiscal cliff" actually materialized -- which could lead to instability. Moody's would then need evidence that the economy could rebound from the shock before it would consider returning to a stable outlook.

Moody's notes that it is difficult to predict when during 2013 Congress will conclude negotiations that result in a budget package. The Aaa rating, with its negative outlook, is likely to be maintained until the outcome of those negotiations becomes clear.

Some Kind Of Settlement Seen

The rating outlook also assumes a relatively orderly process for the increase in the statutory debt limit, says Moody's. The debt limit will likely be reached around the end of this year, and the government's ability to meet interest and other expenses out of available resources would likely be exhausted within a few months after the limit is reached.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Under these circumstances, the government's rating would likely be placed under review after the debt limit is reached but several weeks before the exhaustion of the Treasury's resources. Moody's took a similar action during the summer of 2011.

Here's Where We Stand

Moody's has basically said that unless the red line stops going from the lower left to the upper right, it may -- just may -- do something.

Courtesy Tyler Durden, founder of ZeorHedge.

The views and opinions expressed herein are the author's own, and do not necessarily reflect those of EconMatter.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI