The Hoot

Actionable ideas for the busy trader delivered daily right up front

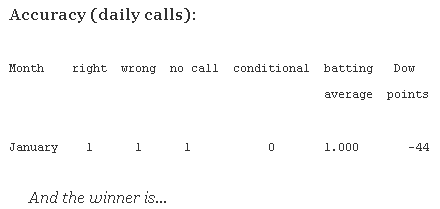

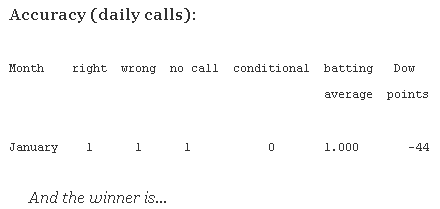

Well I called Friday lower and that didn't happen. But in retrospect, I still think it wasn't an unreasonable guess. It was a 44 point gain for the Dow, but it felt half-hearted as we discuss below. And speaking of fun, let's get right to our circus we call the market. No elephants, but lots of bulls and bears. We crack the whip and see who stands up on Monday.

The technicals (daily)

The Dow: Friday's 0.33% gain came on volume that declined for the third consecutive day. And it was also the third day the Dow clung to its upper BB. Like the skinny kid trying to cross the monkey bars, he can't hold on forever. While the pattern is close to bullish engulfing, the overall gestalt suggests fatigue. With the indicators now very nearly in overbought territory, I have to wonder how much more immediate upside is available.

The VIX: The VIX meanwhile continued its plunge, hitting 13.83 on Friday. It seems hard to believe that only a week ago it hit 23. Anyway, while we're now in a region of support, the lower BB is pretty nearby, at 13.01. With no immediate reversal in sight, more downside is still possible on Monday but I feel it will be limited.

Market index futures:Tonight all three futures are lower at 1:50 AM EST with ES down by 0.09%. That's actually a two point gain since I started writing tonight, following a steady decline earlier Sunday evening. But we got two dojis last Thursday and Friday and the current candle looks like a dark cloud cover that is also breaking away from the upper BB. This is also causing the stochastic to be just about to execute a bearish crossover. While we've been slowly drifting higher the past few days, this move may be about tapped out.

ES daily pivot: Tonight the pivot inches up from 1454.67 to 1457.33.. This means we crossed under the new pivot at midnight. This will remain a bearish sign unless ES can recapture this level, and as I write, it does seem to be sending out a patrol to scout it out, now only 1.33 points below. This skirmish will be worth watching.

Dollar index:On Friday the dollar put in an unusual candlestick pattern called upside gap two crows. It is supposed to be high reliability bearish, but I have little experience with it. We'll see. In any case, the indicators certainly support a top being as RSI is almost pegging the meter at 99.58 and the stochastic appears to be forming a narrow bearish crossover. I'm going to stick to my guns and claim the dollar is going lower Monday.

Euro: And then the euro is putting in a bunch of bullish signs. After a green hammer on Friday, the overnight is trading entirely outside the descending RTC for a bullish setup, even though we're currently down 0.28%. The indicators have all gone oversold now and the stochastic is just about to form a bullish crossover. I think the euro has some decent short-term upside potential here.

Transportation:And the trans are simply on fire, tacking on another 1.17% to extend their impressive winning streak to four. With a solid rising RTC, indicators that have only just barely gone overbought, and a solid green candle, I see no reversal signs here at all. This is by far the strongest chart of the night.

A tough one. We're in a period of some tough slogging - not exactly consolidation, but the big rally is clearly behind us. But we are in a period of strong seasonality and that's nothing to discount. The charts tonight look a lot like they did last Thursday night, only more so. I called the market lower back then but it failed to cooperate. So tonight, with the futures evidently seeing something they liked around 12:30 AM, I'm going to make a conditional call: if ES can break over its pivot (1457.33) and stay there by mid-morning, we'll close higher Monday, else lower.

ES Fantasy Trader

Portfolio stats: the account remains at $100,000 as we continue to wait for the right moment to enter our first trade of the year.

Actionable ideas for the busy trader delivered daily right up front

- Monday higher if pivot passed, else lower, medium confidence.

- ES pivot 1457.33. Holding below is bearish..

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Well I called Friday lower and that didn't happen. But in retrospect, I still think it wasn't an unreasonable guess. It was a 44 point gain for the Dow, but it felt half-hearted as we discuss below. And speaking of fun, let's get right to our circus we call the market. No elephants, but lots of bulls and bears. We crack the whip and see who stands up on Monday.

The technicals (daily)

The Dow: Friday's 0.33% gain came on volume that declined for the third consecutive day. And it was also the third day the Dow clung to its upper BB. Like the skinny kid trying to cross the monkey bars, he can't hold on forever. While the pattern is close to bullish engulfing, the overall gestalt suggests fatigue. With the indicators now very nearly in overbought territory, I have to wonder how much more immediate upside is available.

The VIX: The VIX meanwhile continued its plunge, hitting 13.83 on Friday. It seems hard to believe that only a week ago it hit 23. Anyway, while we're now in a region of support, the lower BB is pretty nearby, at 13.01. With no immediate reversal in sight, more downside is still possible on Monday but I feel it will be limited.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Market index futures:Tonight all three futures are lower at 1:50 AM EST with ES down by 0.09%. That's actually a two point gain since I started writing tonight, following a steady decline earlier Sunday evening. But we got two dojis last Thursday and Friday and the current candle looks like a dark cloud cover that is also breaking away from the upper BB. This is also causing the stochastic to be just about to execute a bearish crossover. While we've been slowly drifting higher the past few days, this move may be about tapped out.

ES daily pivot: Tonight the pivot inches up from 1454.67 to 1457.33.. This means we crossed under the new pivot at midnight. This will remain a bearish sign unless ES can recapture this level, and as I write, it does seem to be sending out a patrol to scout it out, now only 1.33 points below. This skirmish will be worth watching.

Dollar index:On Friday the dollar put in an unusual candlestick pattern called upside gap two crows. It is supposed to be high reliability bearish, but I have little experience with it. We'll see. In any case, the indicators certainly support a top being as RSI is almost pegging the meter at 99.58 and the stochastic appears to be forming a narrow bearish crossover. I'm going to stick to my guns and claim the dollar is going lower Monday.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Euro: And then the euro is putting in a bunch of bullish signs. After a green hammer on Friday, the overnight is trading entirely outside the descending RTC for a bullish setup, even though we're currently down 0.28%. The indicators have all gone oversold now and the stochastic is just about to form a bullish crossover. I think the euro has some decent short-term upside potential here.

Transportation:And the trans are simply on fire, tacking on another 1.17% to extend their impressive winning streak to four. With a solid rising RTC, indicators that have only just barely gone overbought, and a solid green candle, I see no reversal signs here at all. This is by far the strongest chart of the night.

A tough one. We're in a period of some tough slogging - not exactly consolidation, but the big rally is clearly behind us. But we are in a period of strong seasonality and that's nothing to discount. The charts tonight look a lot like they did last Thursday night, only more so. I called the market lower back then but it failed to cooperate. So tonight, with the futures evidently seeing something they liked around 12:30 AM, I'm going to make a conditional call: if ES can break over its pivot (1457.33) and stay there by mid-morning, we'll close higher Monday, else lower.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

ES Fantasy Trader

Portfolio stats: the account remains at $100,000 as we continue to wait for the right moment to enter our first trade of the year.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.