Trump announces 50% tariff on copper, effective August 1

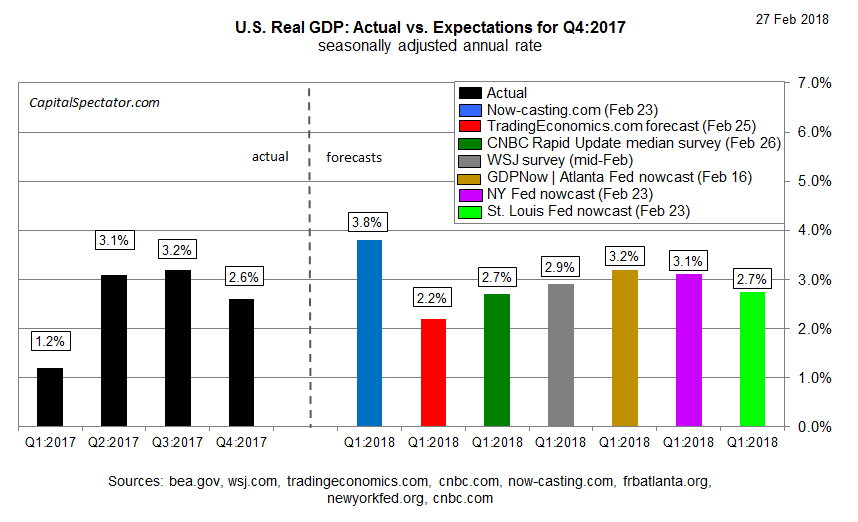

The median estimate for US GDP growth in the first quarter is on track for a modest acceleration, according to the median of several forecasts compiled by The Capital Spectator. If the projection is correct, output will strengthen over the 2.6% rise for last year’s fourth quarter.

The median projection for Q1 is a slightly firmer 2.9%, based on data available as of Feb. 27. The estimates range from a high of 3.8% (Now-casting.com) down to 2.2% (TradingEconomics.com).

There’s still a long road ahead for incoming data, however, and so revision risk remains high for the Q1 profile. The initial round of data for the official GDP report for the first three months of this year via the Bureau of Economic Analysis is scheduled for Apr. 27.

For the moment, however, there’s a case for seeing a modest upgrade in growth. Survey data published by IHS Markit last week fell in line with the 2.9% median estimate for Q1. “Business activity growth accelerated markedly in February, suggesting the economy is growing at its fastest pace for over two years,” said Chris Williamson, chief business economist at IHS Markit. “The upbeat February PMI surveys are indicative of GDP rising at an annualized rate of 3.0%.”

A 3.0% growth rate is also a number cited by the White House in recent days. A leading economic advisor to President Trump last week noted that “we get to the 3 percent in a way that’s transparent, well-documented and heavily leans on peer-reviewed research. We’ve got about a 2.2 percent baseline and then about 0.8 per year because of the president’s policies,” said Kevin Hassett, the chair of the Council of Economic Advisors.

A 3.0% rise in GDP for Q1 compares favorably vs. the Federal Reserve’s full-year outlook for 2018. In December, the Fed projected that economic output will rise 2.5% this year, based on the central bank’s median estimate.

Meanwhile, tomorrow’s revised GDP data for last year’s Q4 is expected to tick down to a 2.5% increase from the current 2.6% estimate, according to Econoday.com’s consensus forecast.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.