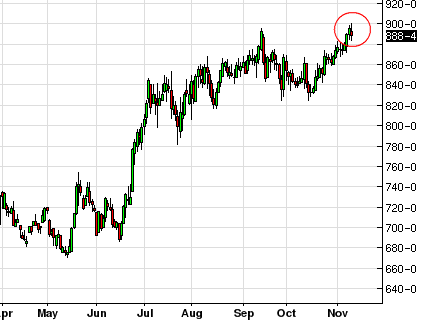

Agricultural commodities are in the news once again. While corn and soy prices have stabilized, wheat continues to rally.

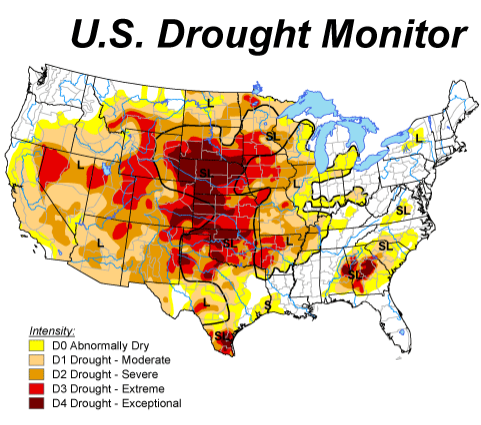

For those of us on the East coast of the US, the drought of 2012 seems like a distant memory, given the recent weather conditions (see post). So what's driving these prices higher? Sadly as the East Coast got hit by Hurricane Sandy and the nor'easter that followed, the Midwest has been in the middle of an ongoing drought. Here is the latest drought monitor map from the University of Nebraska.

Source: The National Drought Mitigation Center at the University of Nebraska-Lincoln, the United States Department of Agriculture, and the National Oceanic and Atmospheric Administration.

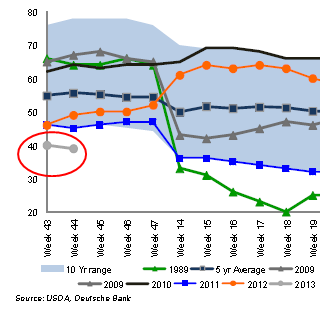

The focus now is on winter wheat. This is the wheat that is planted after the fall harvest. It sprouts before temperatures drop to freezing levels and stays dormant through the winter until the soil warms in early spring. Winter wheat is then ready to be harvested by early summer. The current drought is damaging wheat across Oklahoma and Kansas. Once again we look to the latest USDA report on crop conditions (see post), which shows the percentage of wheat in good/excellent conditions below 40%.

The Republic: ... dry conditions intensified in Kansas, the top U.S. producer of winter wheat. Thursday's update, put out by the National Drought Mitigation Center at the University of Nebraska in Lincoln, showed that the expanse of that state in extreme or exceptional drought climbed roughly 6 percentage points, to 83.8 percent.

Three-quarters of hard-hit Oklahoma — another key winter wheat state — is mired in the two highest forms of drought, up 8 percentage points from the previous week. The Oklahoma Mesonet, a statewide network of environmental monitoring stations, said that 18 of its stations recorded less than one-tenth of an inch of rainfall in October, while 66 measured less than an inch.

"The combination of warm and dry weather was taking a toll on grasses and small grains" such as winter wheat, which as of Monday was running out moisture, David Miskus, a senior meteorologist with the Climate Prediction Center, wrote in authoring Thursday's report.

Thirty percent of Oklahoma's fledgling winter wheat crop was found to be in poor to very poor shape, a decline of 18 percentage points from the previous week, as topsoil moisture in the state continues to grow increasingly parched.

"With so much of Oklahoma already in (extreme or exceptional drought), it is getting difficult to degrade the state further," Miskus wrote.

A major driver of the overall winter wheat harvest yields will be the amount of rain in the spring. With a great deal of wheat already in trouble, the "weather premium" will be priced into wheat futures until there is clarity on precipitation levels next year.

DB: Concerns about production and quality of global wheat crops have intensified. Focus is also shifting to the US as crop conditions for winter wheat are poor on an historical basis.

However, spring rainfall is the key to wheat yields. Our work shows that precipitation before dormancy has a greater impact on abandonment than yields. We expect a weather premium to remain until the outlook for spring weather becomes clearer.

For now however, wheat prices will remain near recent highs.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI