Are DOGE layoffs set to resume?

The University of Michigan Preliminary Consumer Sentiment for September came in at 95.3, down from the August Final reading of 96.8. Investing.com had forecast 95.1.

Surveys of Consumers chief economist, Richard Curtin, makes the following comments:

Consumer confidence edged downward in early September due to concerns over the outlook for the national economy. Consumers' assessments of current economic conditions improved, however, with the Current Conditions Index reaching the highest level since November of 2000. The two hurricanes had a greater impact on expected economic conditions. Across all interviews in early September, 9% spontaneously mentioned concerns that Harvey, Irma, or both, would have a negative impact on the overall economy. Among those who mentioned the hurricanes, the Sentiment Index was 80.2, while among those who did not spontaneously mention either hurricane, the Sentiment Index remained unchanged from last month at 96.8. Given the widespread devastation in Texas and Florida, it is not surprising to find these very negative initial reactions, nor would it be surprising if these negative assessments last longer than following most past hurricanes. While consumers anticipated slight increases in gas prices and a slightly higher overall inflation rate, those concerns were neutralized by the best assessments of their financial situation in more than a decade. Renewed gains in incomes as well as rising home and equity values have acted to counterbalance the negative impacts from the hurricanes. Given the current resilience of consumers, recent events are unlikely to derail confidence. [More...]

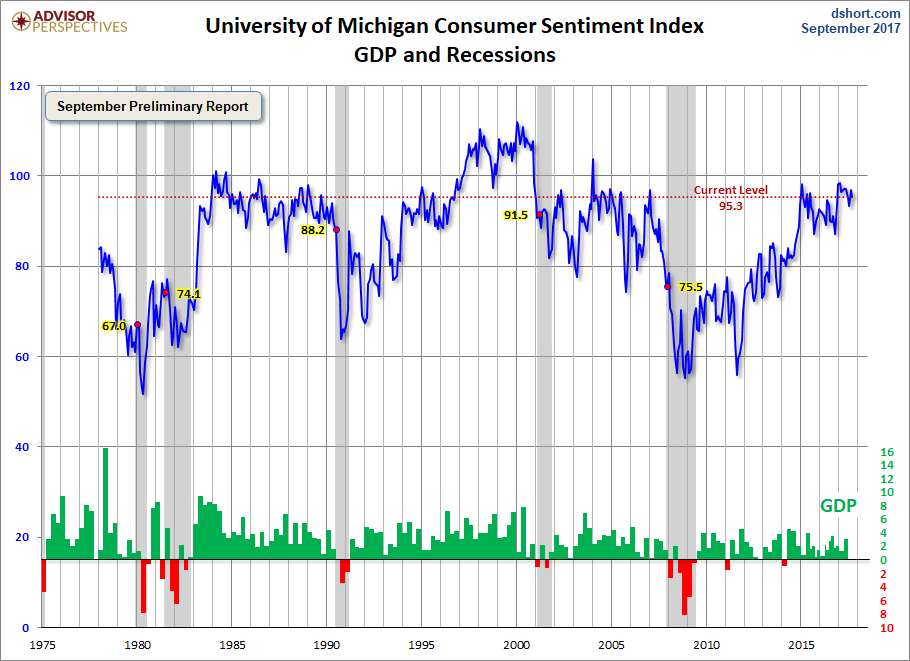

See the chart below for a long-term perspective on this widely watched indicator. Recessions and real GDP are included to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

Michigan Consumer Sentiment

To put today's report into the larger historical context since its beginning in 1978, consumer sentiment is 11.2 percent above the average reading (arithmetic mean) and 12.5 percent above the geometric mean. The current index level is at the 79th percentile of the 477 monthly data points in this series.

The Michigan average since its inception is 85.6. During non-recessionary years the average is 87.8. The average during the five recessions is 69.3. So the latest sentiment number puts us 26.0 points above the average recession mindset and 7.5 points below the non-recession average.

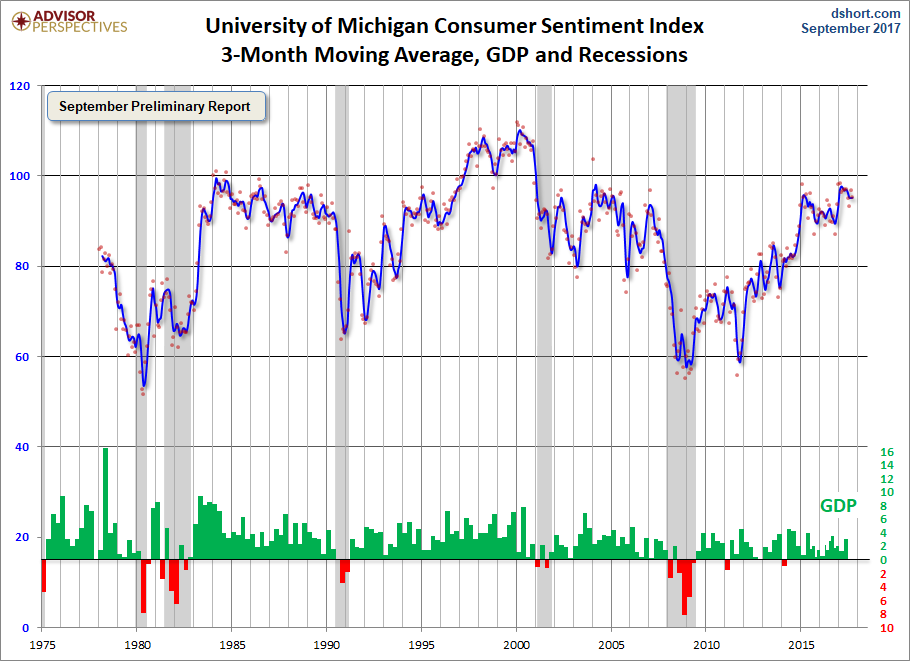

Note that this indicator is somewhat volatile, with a 3.0 point absolute average monthly change. The latest data point saw a 1.5 percent change from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average.

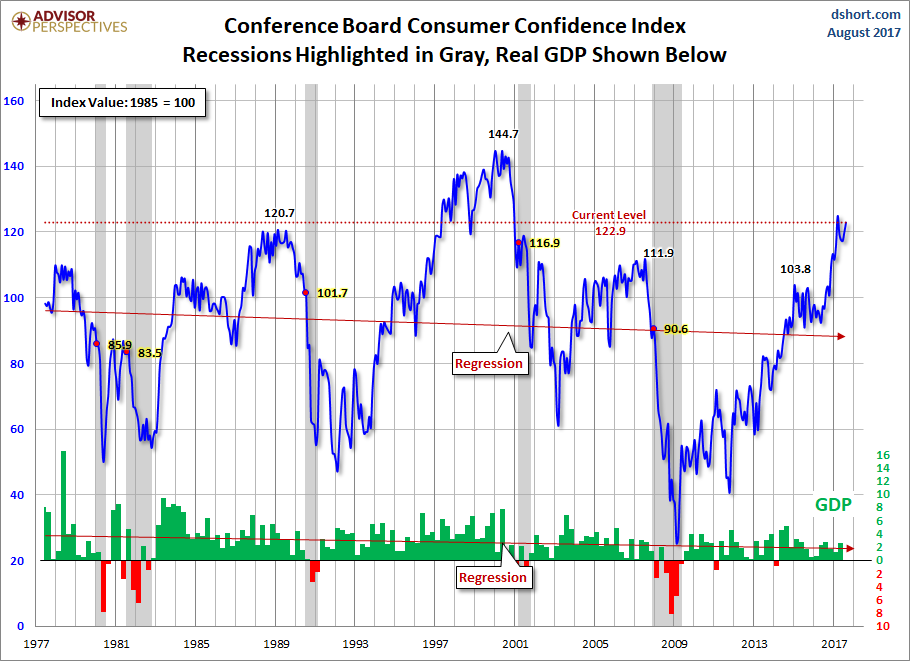

For the sake of comparison, here is a chart of the Conference Board's Consumer Confidence Index (monthly update here). The Conference Board Index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan Index.

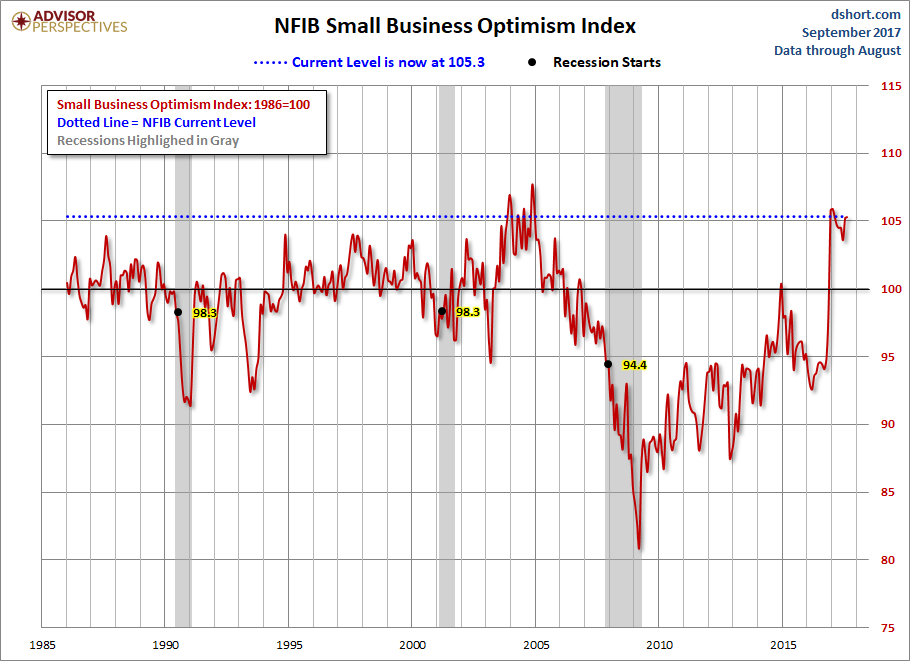

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here).

The general trend in the Michigan Sentiment Index since the Financial Crisis lows has been one of slow improvement.The survey findings since December 2015 saw gradual decline followed by a bounceback later in the year with its interim peak in January of 2017.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.