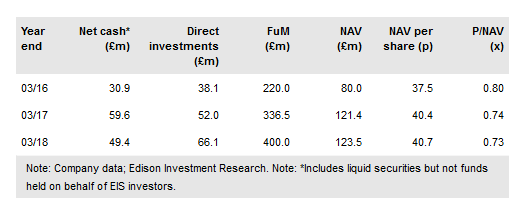

Mercia Technologies (LON:MERCM) (Mercia) is a leading player in the funding and scaling of high growth companies from the UK regions, with a business model that is significantly de-risked vs peers. £400m of managed funds (Mercia Fund Managers, MFM) are used to predominately support all early-stage activity, whilst also providing meaningful revenue to offset group operating costs. As a result, the balance sheet investment is reserved for only the most promising companies or ‘Emerging Stars’ sourced from MFM. The group has a strong cash position and an experienced management, as well as a good track record, with three successful full cash exits to date. The shares trade at 0.73x NAV, not including the contribution from MFM, which we estimate at a further c 9p per share (total discount to NAV of 0.60x).

A differentiated hybrid model

Mercia’s differentiated business model combines managed funds (through its MFM subsidiary to nurture early-stage investment activity) and balance sheet investment, which is used to scale Emerging Stars from the MFM portfolio. The £400m profitable MFM business produced revenues of £9.6m in FY18, which offset most of the group’s operating costs. MFM has c £230m cash for investment over the next 4–5 years, which should lead to a diverse pipeline for future Emerging Stars. The strong balance sheet enables the continued support of existing direct investments, while selectively expanding the direct investment portfolio with new Emerging Stars. At FY18, unrestricted cash of £49.4m provides c two years of funding.

To read the entire report Please click on the pdf File Below..

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI