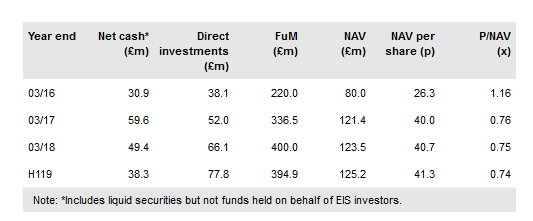

Mercia Technologies PLC (LON:MERCM) H119 results reflected continued steady progress across the portfolio, with net assets rising slightly to £125.2m and FuM remaining stable at £394.9m. The direct investment portfolio increased 17.7% to £77.8m, reflecting £9.2m of cash investment as well as £2.6m fair value uplift. Key portfolio companies continue to deliver against commercial milestones and with c £60m of investment expected in FY19, Mercia is well positioned for further progress in FY19. The shares continue to trade at a significant discount to NAV (0.74x) and peer group comparators.

17.7% growth in direct investment portfolio

Mercia reported H119 net assets of £125.2m, which compares to £123.5m at FY18. As a result of a £9.2m of investment and £2.6m fair value uplift, the direct investment portfolio grew to £77.8m from £66.0m at FY18. Within the Mercia Fund Managers (MFM) subsidiary, FuM remained steady at £394.9m (vs c £400m at FY18). Importantly, MFM also contributed the majority of £5.27m revenues at H119 (vs £4.85m in H118), with a 19.1% reduction in operating expenses to £0.69m vs the comparable period (£0.85m for H118). Mercia continues to expect to invest c £60m during FY19, of which £20-25m will be direct balance sheet investments.

To read the entire report Please click on the pdf File Below..

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI