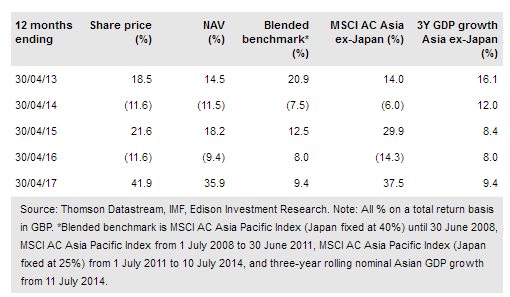

Martin Currie Asia Unconstrained Trust PLC (LON:MACP) adopted Martin Currie’s Asia Long-Term Unconstrained (ALTU) strategy in July 2014, aiming to generate returns in line with Asia-Pacific ex-Japan GDP growth. The trust has consistently traded at a wider discount than its peers, but the differential has recently narrowed following the board’s proposal on 4 April 2017 to increase the dividend meaningfully. Based on MCP’s end-FY17 ex-income NAV, the dividend yield would more than double, lifting the yield to c 4.5%. MCP has outperformed its Asian GDP growth benchmark since adopting the ALTU strategy and over shorter time periods, with particularly strong relative performance over the last 12 months, helped by sterling weakness.

Investment strategy: Unconstrained Asian exposure

The ALTU strategy aims to capture the superior growth of the Asia ex-Japan region, while mitigating some of the downside risks. MCP’s portfolio of 20-30 stocks is constructed through an initial screening followed by in-depth fundamental research. Potential investments are subject to an assessment of their corporate governance track records and a 40-60 page forensic accounting report. Portfolio positions are held for the long term, which lowers costs and allows the trust to benefit from the positive compounding effects of rising share prices. MCP has a £15m loan facility, which is partly drawn down. At end-March 2017, gross gearing was 4.4%.

To read the entire report Please click on the pdf File Below

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI