Stock market today: S&P 500 in fifth straight record close as earnings shine

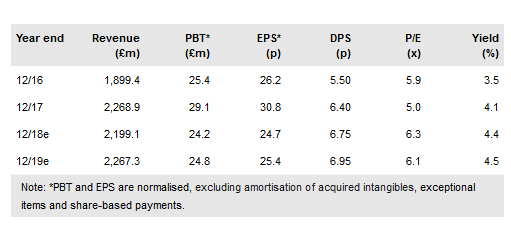

Marshall Motor Holdings PLC (LON:MMHM) ongoing businesses delivered a record H1 profit before tax despite continued challenges in the UK new and used car markets. While comparatives are easing in the second half, new car supply-side constraints may impact in Q3 as new vehicle testing procedures are introduced. We continue to forecast a fall in H2 profitability, but the strength of the H1 contribution and a strong balance sheet lead us to increase estimates modestly by around 3% for this year and next.

H118 delivers to expectations

Continuing H118 revenues fell by 0.4% to £1,162.9m (H117 £1,167.9m) following the disposal of the leasing business in November 2017. Underlying profit before tax of £16.4m (H117 £16.2m) grew by 1.2%, in line with expectations that it would be marginally ahead. The company exited some low margin rental fleet sales last year. Excluding these, even with the decline in diesel volumes, new vehicle unit volumes fell 3.5% y-o-y, outperforming the wider market drop of 6.3%. The improved fleet sales mix helped to partially mitigate the impact of the lower volumes on the New segment gross margin. Actions to improve Used vehicle profitability were visible, with sequential sales and gross profit up 15.3% and 18.7%, respectively.

To read the entire report Please click on the pdf File Below: