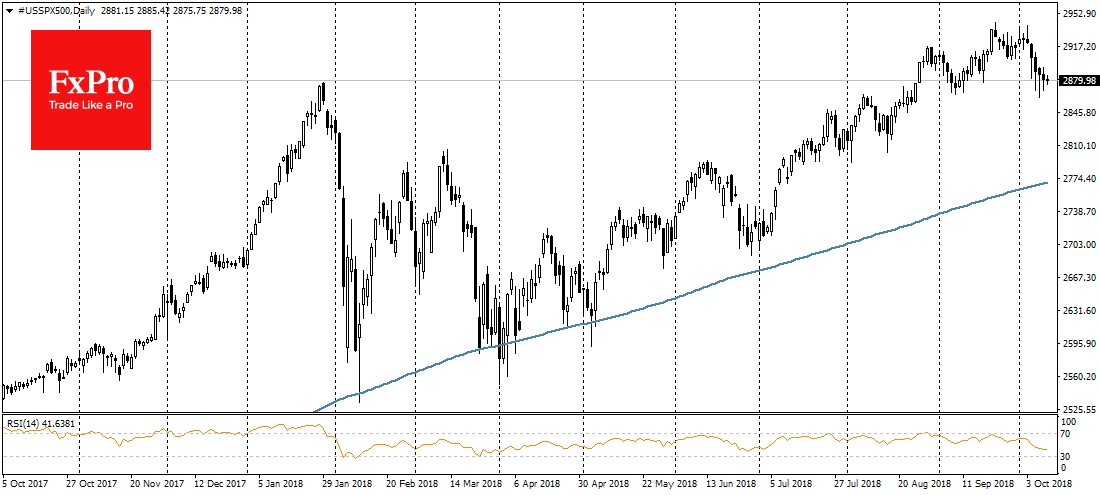

The stock markets take a pause in the decline after a few days of increasing pressure, but the yields growth of American bonds allows to talk about maintaining a negative trend.

According to the results of trading on Tuesday, the futures on S&P 500 lost another 0.2%, increasingly depending on the peak levels of the beginning of October. However, on Wednesday morning the markets are dominated by mixed dynamics. MSCI Asia ex Japan has hardly changed this morning. Shanghai index loses 0.2%, Hong Kong adds 0.3%.

The US dollar also gave in some of the positions conquered in the previous days. The dollar index lost 0.6% after touching highs for 1.5 month not without the help of the positive news from Italy and Britain.

The Italian economy minister promised to do everything that was necessary to ensure that the turbulence of financial markets would not spill into a financial crisis. It helps single currency to turn to growth from the levels near 1.1430 and it is trading above 1.1500 at the moment.

The British pound has added more than 1% over the recent 24 hours after the reports that the number of those who do not want to leave the EU without a deal in the parliament is growing, preferring "soft Brexit”. The GBPUSD pair rose to 1.3170, as the markets consider positively an increase in the chances of a deal between Britain and the EU.

However, it is necessary to remain cautious, as in the previous months the markets had already made some false starts, hoping for an ambulance deal, but that ended by another one sale-off of the Pound. As it has often been noticed p in Europe in recent years, the decision has been postponed till the last moment, increasing uncertainty.

Political events in Europe have somewhat drawn attention from the U.S. debt markets and there is still pressure on the bonds. The yield of 10-Year bonds updated 7-year highs, exceeding 3.25% level. The yield of 2-year notes rose yesterday to the maximum in 11 years. This is a natural process amid the increased Federal Reserve rates and increased confidence in the U.S. Economy. However, the yield growth negatively affects the attractiveness of the stock markets, where the U.S. stock indices depart from the historical highs, and in bourses in China have entered the Bear market phase.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.