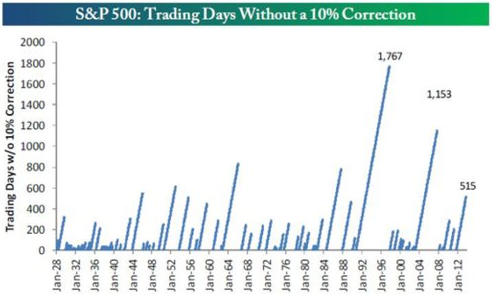

One interesting aspect of this bull market run for the S&P 500 Index has been the absence of a 10+% correction.

It seems on a daily basis the talking pundits on business news channels and in print are certain an equity market correction is just around the corner. For those investors under-invested in equities, a correction would certainly be a welcome event. Market corrections, however, are hard (if not impossible) to predict and when they do occur, they tend to surprise investors. As the below chart of market advances without a 10% correction shows, it is not uncommon for the market to move higher without significant pullbacks.

As noted in the Bramesh article,

- from March 2003 to October 2007 (the entire length of the last bull market), the index went 1,153 trading days without experiencing a 10% correction.

- the longest streak on record without a 10% correction was from October 1990 to October 1997, and that lasted 1,767 trading days.

- if the current streak matched the 1990 to 1997 streak, this bull market would run to October 1, 2018, nearly five years from now.

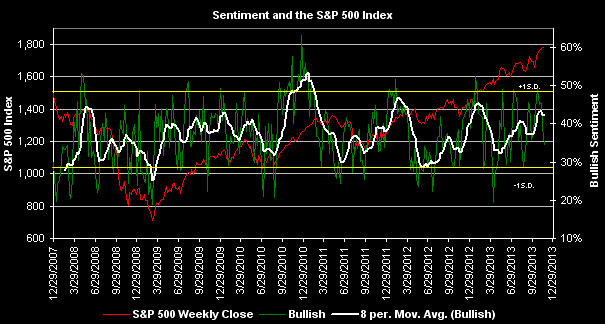

The other factor that seems to be preventing a so called market "melt up" is investor sentiment has not become overly bullish. In the sentiment survey release by the American Association of Individual Investors earlier this week, bullish sentiment actually feel 4.8 points after falling 4.3 points in the prior week. Investors should keep in mind though, sentiment indicators are most predictive at their extremes.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.