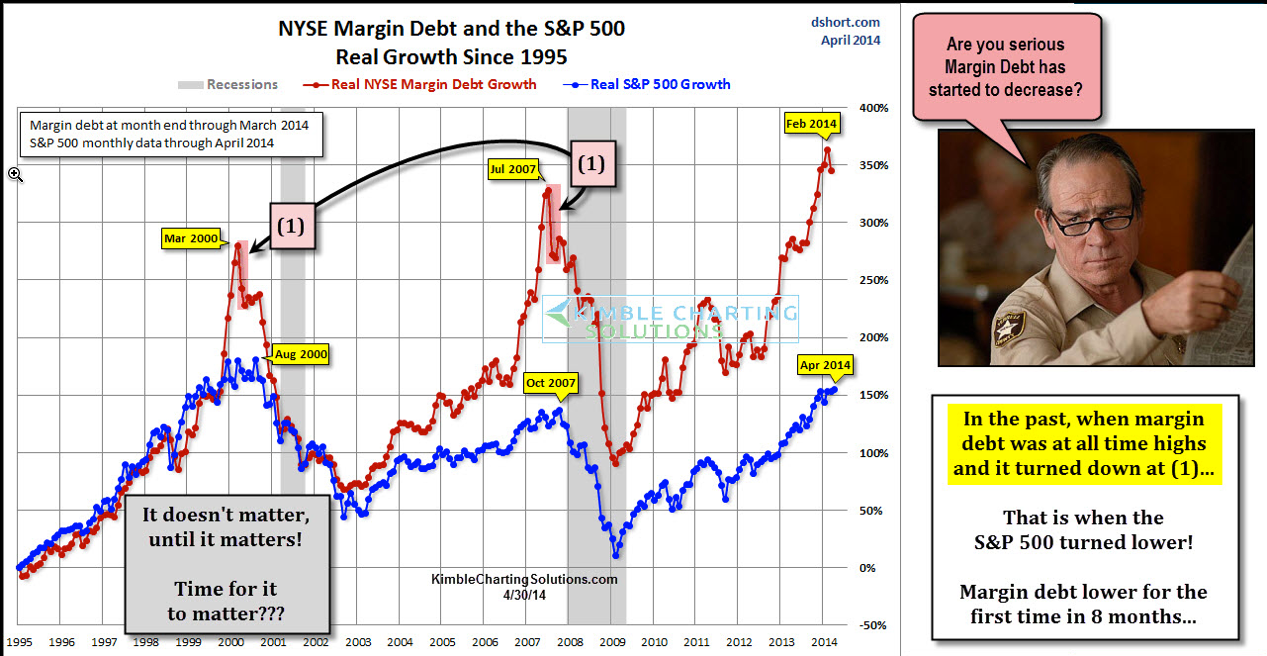

It doesn't matter until it matters! Will a decline in margin debt from all-time highs matter this time? Doug Short each month does an excellent analysis on margin debt and the latest update is now out. (see current info here)

In the past margin debt at historical levels didn't seem to matter, until margin debt started decreasing. The above chart highlights that at each (1), margin debt was at historical highs and then turned south and the S&P 500 soon followed.

In my humble opinion one should not look at margin debt as the holy grail to portfolio construction. It has been a good tool in helping to know when to overweight and underweight towards risk assets.

Margin debt has been swiftly pushing higher for the past 8 months in a row and now slipped a little this past month. IF....IF margin debt should start decreasing swiftly, history would suggest something different is taking place in the mind of aggressive investors.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.