Bitcoin price today: steady at $119.3k, Ether near record high on corporate buying

Sometimes in history, investors feel so confident about the future of stocks, they actually use up all their available cash and then borrow money to invest in the stock market. Now appears to be one of those times

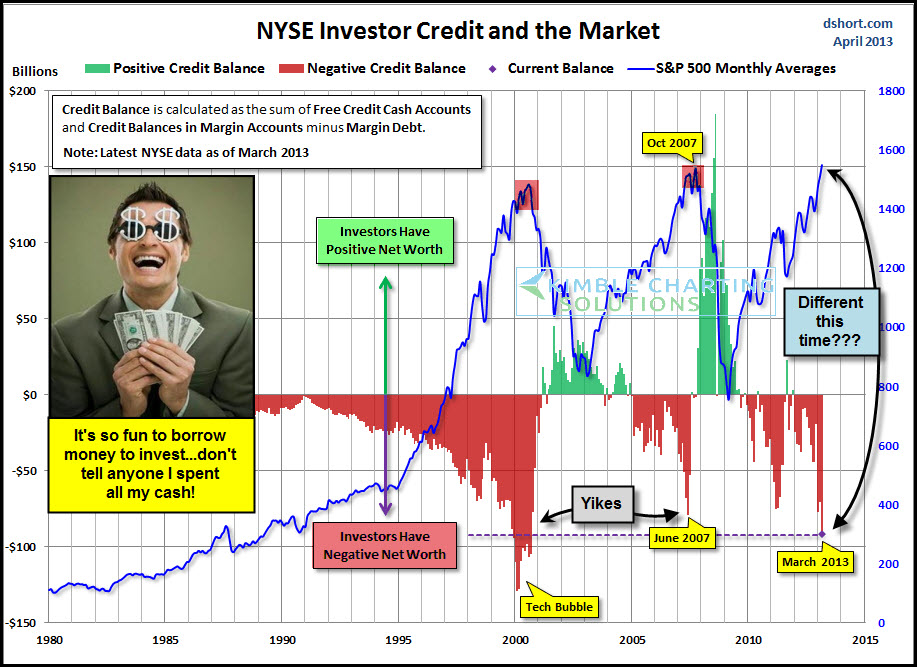

The outstanding chart below was created by Doug Short, see his excellent work here.

Positive net worth takes place when: Investors have little money borrowed and plenty of cash in there brokerage accounts. (2003 and 2009)

Negative net worth takes place when: Investors have large amounts of money borrowed (on margin) and little cash in their brokerage accounts. (2000, 2007, 2011 and now)

The above chart reflects that only one other time in history has negative net worth been this low, which was the tech bubble back in 2000. The prior two times that negative net worth were this low was 2007 (50% S&P 500 decline) and 2011 (17% S&P 500 decline).

The above chart of Credit Balance/Net Worth shouldn't be used as a market timing tool, yet it history holds true, it has reflected times when investors should load up the truck in stocks (Positive net worth was high at the 2003 and 2009 lows) and it did reflect times when investors should have lowered stock exposure (Negative net worth was low in 2000 and 2007).

I believe the top will be in when: high yield funds and advance/declines show weakness in combination with the above net worth figures. Stay tuned to see if it's going to be different this time.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI