We’re all desperate for a quick economic recovery, but desperation can be the enemy of informed thinking for looking ahead.

As an example, consider recent commentary in some corners that a V-shaped economic recovery (a strong, quick bounce-back) for the US is likely because that’s the usual path, based on reviewing the history of gross domestic product (GDP), the broadest measure of economic activity. This spin on macro history looks encouraging, but assuming GDP is the last word on economic recoveries is assuming too much.

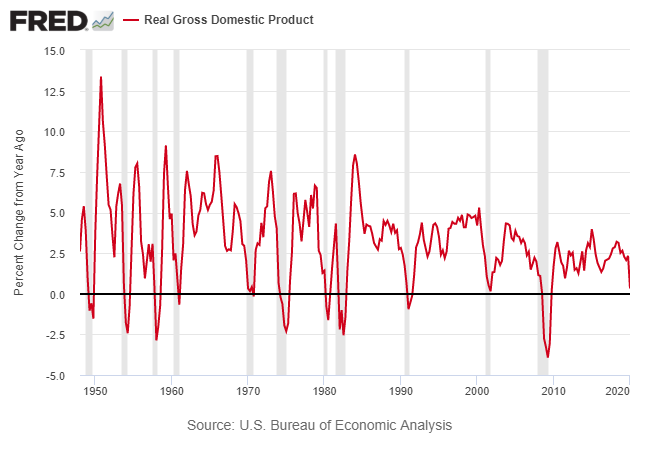

Let’s start with the history that inspires expectations for a V recovery. The reasoning goes like this: GDP has a tendency to bounce back quickly after recessions, as the chart below suggests. Using the 1-year percentage change, it’s clear that GDP rebounded sharply and quickly following the end of every US recession since 1950. Note that in several cases, GDP is growing again by the end of the recession. In the 1970 recession, GDP barely fell, and only for a brief period, in year-over-year terms. At other times, the rebound is slower, but growth returns relatively quickly.

But economic history by this definition is misleading. First, the recession dates (shaded area in chart above) are set by the National Bureau of Economic Research after the fact and so the endpoint of downturns are designed to coincide with a GDP-based recovery. From an academic perspective, that’s perfectly reasonable since the results are valuable for studying and modeling the broad sweep of macrohistory.

For a real-world perspective, however, there are other issues to consider. The basic challenge: GDP isn’t a practical measure of economic conditions, especially for the average person. For most people, GDP stats are basically meaningless. It doesn’t help that there are a number of problems with the data.

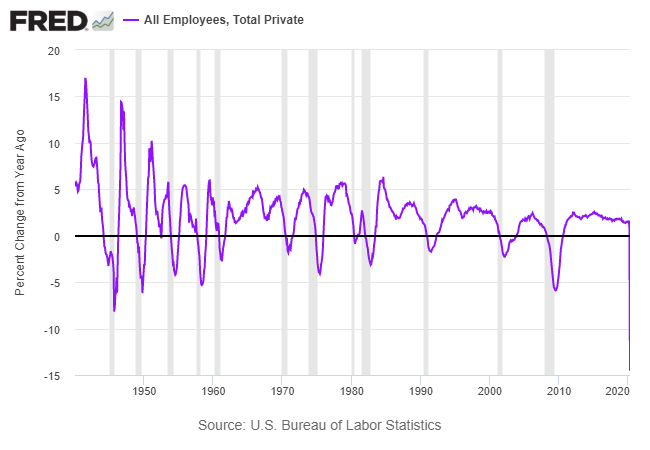

A better measure of how real people experience the business cycle: the ebb and flow of jobs creation. Losing your job is a recession; finding employment represents recovery. Looking at the business cycle through this lens paints a more complicated picture.

Perception on Main Street is always important for recoveries, and that will be true in the extreme this time. Given the sharp, dramatic jobs losses, which will probably get worse, sentiment in the broad population will be highly relevant for charting the path of the post-recession trend. On that front, jobs will arguably be the most relevant stat.

With that in mind, consider how private employment has fared on a rolling one-year basis in the past. As the next chart below reminds, the labor market often contracts through a recession and for a number of months after the downturn officially ends, based on NBER dates. In some cases, a positive one-year gain in private employment doesn’t arrive until several years after the recession’s official end.

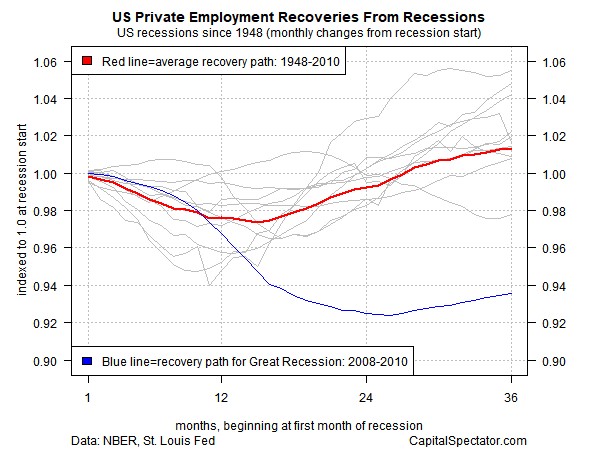

For another perspective, consider how private employment stacks up on a monthly basis from the start of every US recession since 1948 through the Great Recession. The chart below shows the path of private employment starting at each recession’s first month through the next 36 months. The red line represents the average path.

The tendency is that employment doesn’t return to the level at the recession’s start until more than two years later, on average. In the last recession (blue line in chart above), the bounce-back for employment growth was unusually slow. Even after 36 months since the Great Recession’s start, private payrolls still hadn’t recovered to the level that prevailed at the start of the downturn.

That brings us to the current downturn, which is unusual in several respects. For starters, the recession arrived with lightning speed and delivered dramatic losses. As we learned last week, US payrolls fell 20.5 million and wiped out a decade of jobs growth in one month.

The positive spin is that a sharp drop in employment because it was self-inflicted to manage COVID-19 risk, will soon lead to a strong, rapid recovery once the economy reopens. Maybe—let’s hope.

But history leaves plenty of room for caution. In “normal” recessions, the labor market’s recovery takes a couple of years to rebound. Will this time be different? No one knows. There’s a huge amount of uncertainty for modeling how employment fares in the months ahead. If the virus is contained and infection and death rates fade, the odds are likely higher for a quick employment recovery. But the longer the recession rolls on, the deeper and wider the economic damage – damage that will work against the odds of a sharp, swift V recovery in payrolls. All the more so if there’s a second coronavirus wave in the fall and winter. There’s also a risk that some regions and states open too early, laying the groundwork for a rebound in COVID-19 fatalities.

For these and other reasons, it’s not yet clear how the current recession will unfold. We already know it’s the deepest since the Great Depression in the 1930s. The mystery: When does the recovery start and how strong will it be? No one knows at this point because it Covid-19’s future remains highly uncertain. Trying to reduce the uncertainty by looking to GDP’s history may be comforting, but it’s almost surely misleading.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.