Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

Basic materials are the most boring of businesses. They include production of steel and aluminum and mining. Doesn’t that copper mine above look like a fun place to work? However, they are the backbone of society, and when these companies are doing well it is a good sign for the economy.

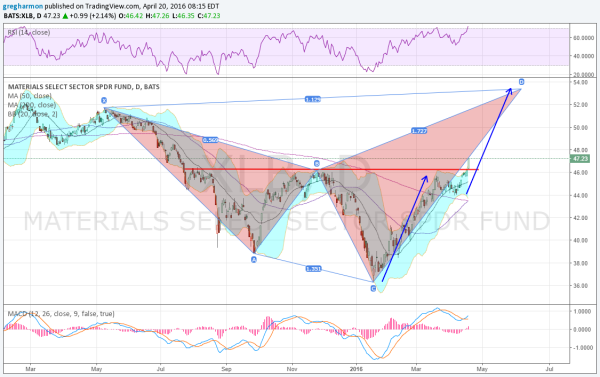

Tuesday marked an important day for basic materials in the stock market. The ETF that tracks this sector, Materials Select Sector SPDR (NYSE:XLB), confirmed a break out of a bottoming process after a pullback that began a year ago. The price of the ETF made a new 9-month high, moving up on a strong Marubozu candle.

The chart above shows that move, as the Bollinger Bands® first squeezed and then opened for the explosion higher. The thrust took the price out of the Bollinger Bands, so there may be a need to consolidate before a further run, but there are plenty of good signs for the future in the chart.

The RSI is in the bullish zone, perhaps a bit overheated, but strong, while the MACD is crossing up and rising. Both momentum indicators support further upside. There is a bullish golden cross printing today as well with the 50-day SMA crossing up through the 200-day SMA.

How far will it run? We will need to wait and see, but there are two technical measures that suggest the ETF may build a 13% move higher. The break of the March consolidation gives a measured move higher to about 53.50. And the bearish shark harmonic pattern has a potential reversal zone right there as well at 53.40. Neither are a guarantee, but suggest it is time to build a position in basic materials in your portfolio.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.