Fed’s Bowman calls for decisive rate cuts to address job market fragility

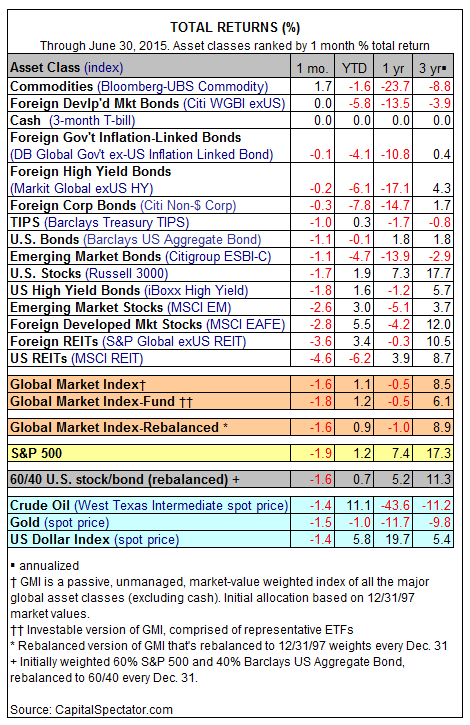

The markets staggered to the year’s midpoint with a thud, with most of the major asset classes suffering losses in June. The exception: broadly defined commodities (Bloomberg Commodity Index), which posted a modest 1.7% gain last month. The rest of the field was either flat or (in most cases) in the red. The big loser: US real estate investment trusts (REITs), which shed a hefty 4.6% in June, based on the MSCI REIT Index, leaving this measure of securitized real estate off by more than 6% so far in 2015.

The creeping incidence of losses in recent history continues to take a toll on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI slumped a hefty 1.6% last month, paring its year-to-date gain to a thin 1.1%. US stocks (Russell 3000) were also clipped in June, suffering a 1.7% setback, which translates to a mild 1.9% rise for the first half of the year.

Are the weak returns for GMI a surprise? No, not really. The Capital Spectator’s monthly risk premia forecasts (see June’s update, for instance) have been quite soft lately—dramatically so relative to the stellar results in recent years. Although GMI’s 3-year, 5- and 10-year annualized trailing returns are still quite lofty relative to the expected performance, the crowd is inclined to squeeze the gap these days.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!