Risk assets were lower overnight despite dovish minutes from the last FOMC policy meeting (suggestive of additional quantitative easing possibilities) and positive news from the IMF (showing willingness to increase available funding for bank liquidity). Markets for the most part have been ignoring macro data but some of the move could be explained by the weaker US GDP and Chinese PMI figures and this is leading to speculation that non-European regions are feeling the effects of the global economic slowdown.

Other problematic issues are seen with the gridlock in the US Congressional budget plans but both Moody’s and Standard and Poor’s released a statement saying there would be no credit downgrades resulting from this. Fitch was the exception, reiterating their statement that the US credit outlook might be lowered to “negative” if political obstacles are seen limiting long term growth forecasts.

Positive economic data was, however, seen in Norway, where GDP figures were mixed with some key areas lower than market expectations. Headline GDP rose 1.4% on a quarterly basis with much of the rise being attributed to oil exports (helping to balance the weakness that was registered in the domestic consumption component of the report). In other Nordic data, Sweden released its unemployment rate, which showed a rise to 6.9%. Markets are divided on the policy bias of the central banks in these regions, so any indication of new accommodative policy measures will bring some support back to the area’s equity markets.

In the UK, Prime Minister Cameron made some noteworthy comments, saying that deficit reduction prospects remain challenging (due to declines in growth forecasts) and this appears to be an implicit suggestion that austerity measures will continue to be drafted for the country’s economy. Other attention was given to Bank of England member Miles who made comments on the state of the UK real estate market, saying that the longer term percentage of homeowners is likely to decrease as a result of the European debt situation.

Market volatility is starting to slow as we come to the end of the holiday week and this is expected to continue, for the most part. It must be remembered, however, that recent years have seen some drastic price moves during these times as fewer market players leads to much lower liquidity levels.

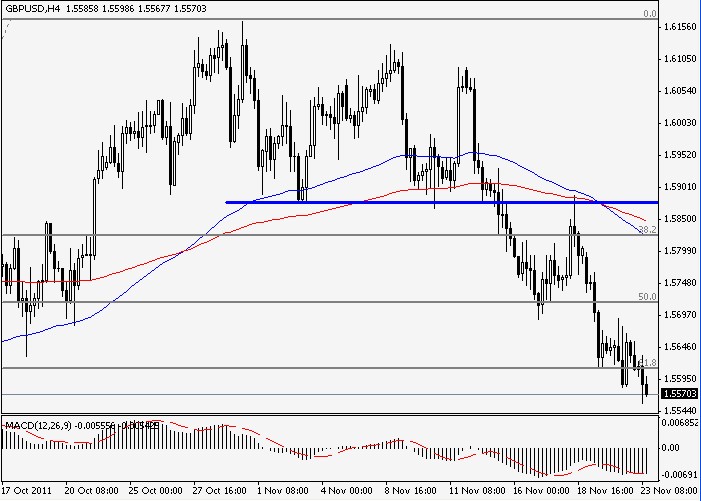

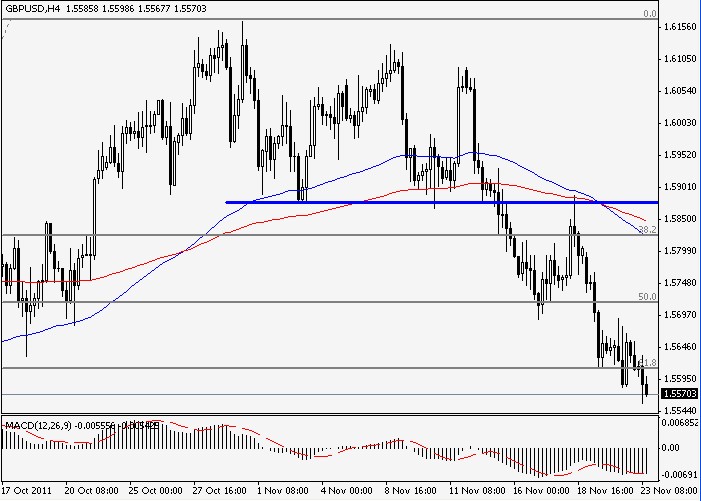

The GBP/USD has now fallen through the daily 61.8% Fib support level that we mentioned previously and this adds strength to the longer term bearish view of this pair. We are now expecting a full retracement into the end of the year, given that indicator levels have yet to reach oversold territory in the daily charts. Shorter term, some consolidation is likely this week, and prices could test resistance at 1.5690 before heading lower.

The DAX has completed its head and shoulders pattern, with prices now falling to Fib support at 5540 with very little bounce. A close below this area is very ominous longer term and the downward channel and bearish indicator reading are in line with this view. First resistance comes in at the old support levels, but much extension beyond here is unlikely for the rest of this week.

Other problematic issues are seen with the gridlock in the US Congressional budget plans but both Moody’s and Standard and Poor’s released a statement saying there would be no credit downgrades resulting from this. Fitch was the exception, reiterating their statement that the US credit outlook might be lowered to “negative” if political obstacles are seen limiting long term growth forecasts.

Positive economic data was, however, seen in Norway, where GDP figures were mixed with some key areas lower than market expectations. Headline GDP rose 1.4% on a quarterly basis with much of the rise being attributed to oil exports (helping to balance the weakness that was registered in the domestic consumption component of the report). In other Nordic data, Sweden released its unemployment rate, which showed a rise to 6.9%. Markets are divided on the policy bias of the central banks in these regions, so any indication of new accommodative policy measures will bring some support back to the area’s equity markets.

In the UK, Prime Minister Cameron made some noteworthy comments, saying that deficit reduction prospects remain challenging (due to declines in growth forecasts) and this appears to be an implicit suggestion that austerity measures will continue to be drafted for the country’s economy. Other attention was given to Bank of England member Miles who made comments on the state of the UK real estate market, saying that the longer term percentage of homeowners is likely to decrease as a result of the European debt situation.

Market volatility is starting to slow as we come to the end of the holiday week and this is expected to continue, for the most part. It must be remembered, however, that recent years have seen some drastic price moves during these times as fewer market players leads to much lower liquidity levels.

The GBP/USD has now fallen through the daily 61.8% Fib support level that we mentioned previously and this adds strength to the longer term bearish view of this pair. We are now expecting a full retracement into the end of the year, given that indicator levels have yet to reach oversold territory in the daily charts. Shorter term, some consolidation is likely this week, and prices could test resistance at 1.5690 before heading lower.

The DAX has completed its head and shoulders pattern, with prices now falling to Fib support at 5540 with very little bounce. A close below this area is very ominous longer term and the downward channel and bearish indicator reading are in line with this view. First resistance comes in at the old support levels, but much extension beyond here is unlikely for the rest of this week.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.