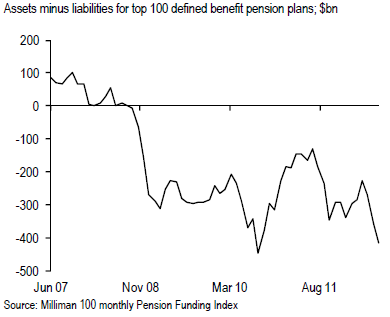

The corporate pension lobby is increasingly energized to have the US Congress approve the 25-year "smoothing" for pensions. With interest rates falling, defined benefits corporate pensions are once again becoming severely underfunded.

Increasing the discount rate would lower the net present value of pension liabilities making them look less underfunded. The assets however will be growing at the current extremely low rate of return and will likely be insufficient to meet pension obligations in the future.

NCPA: Private corporations are asking Congress to change how they calculate their annual pension contributions, which could create a huge unfunded liability for taxpayers, say Jason J. Fichtner and Eileen Norcross, senior research fellows with the Mercatus Center.

The law requires corporate plans to measure their liabilities, and determine annual contributions to fund them, using the rate of return on corporate bonds -- the discount rate. Now, corporations are lobbying for Congress to allow them to increase the discount rate. This allows accountants to assume better investment performance, setting aside fewer dollars for future pension obligations.

- The provision in the Senate-passed version of the transportation bill currently under consideration in the House would allow corporations to use a 25 year average rate as opposed to the current 2 year average.

- This would increase the current discount rate from the 4 percent range to roughly 6 percent.

- Since liabilities are sensitive to discount rate assumptions, the plan's liability will change roughly 15 percent for every one percentage point change in the discount rate.

- For example, Boeing reports that a mere quarter of a point increase in the discount rate could cut its pension liability by $1.7 billion.

FT: Pressure is growing on the UK government and Pensions Regulator to follow their US and European counterparts and give corporate pension funds more flexibility in how they calculate their level of funding for setting company contributions.

Accounting rules in many countries require pension funds to mark their liabilities to market by discounting them at current bond rates. The low level of interest rates has put pressure on scheme funding by inflating liabilities, and authorities in some countries have decided to help scheme sponsors by moving away from the mark-to-market approach.

Governments in the US and the Netherlands are extending “smoothing," which allows funds to discount their liabilities with an average rate over a set time period. Elsewhere, Sweden has put a lower limit on rates, and Denmark has set a higher rate for long-term liabilities

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.