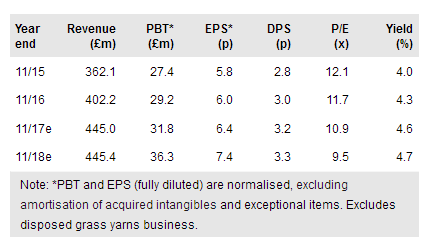

Disappointing demand in Civil Engineering (CE) markets causes us to reduce earnings estimates. Despite this, FY17 is expected to show good progress overall although the reduction in net debt from the half year will now be less than previously anticipated. Good underlying performances from three business units are being partly obscured by CE. Resolving this is likely to benefit group valuation in our view.

Mixed H2 business unit performance

Civil Engineering demand has not picked up as anticipated in H2; while western Europe is slightly better, central and eastern Europe remain very subdued. This is understood to reflect low project activity rather than any loss of market share, but a shortfall in specification projects in particular affects business unit profitability and will reduce working capital inflow. Low & Bonar's (LON:LWB) other business units have fared better; we expect all three to report higher H2 EBIT y-o-y, with Building & Industrial and Interiors & Transportation achieving solid mid-teens margins despite upward pressure on polymer-based input costs. Regionally North America and China appear to be the stronger territories served with some variability in Europe.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI