Historically, stocks, yields and copper often trend in the same direction. But unless it's different this time, one asset(s) is way out of whack.

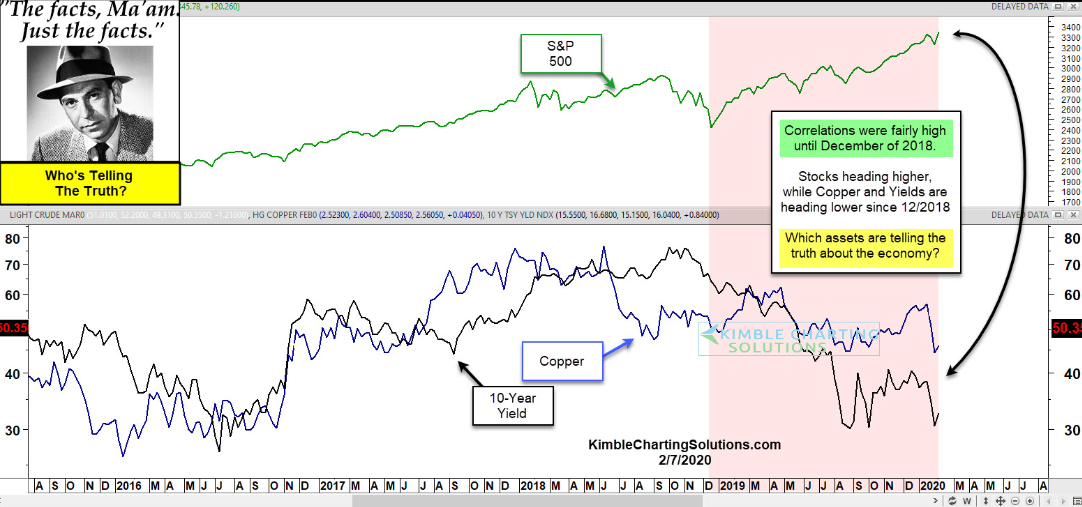

This chart looks at the S&P 500, copper and the yield on the 10-year note over the past 5 years.

From late 2015 until late 2018, correlations between the three were pretty decent, especially at the 2016 lows.

A big correlation change has taken place since December of 2018. Since then, the S&P has rallied while yields and copper have experienced declines, creating one of the largest spreads between the three in quite some time.

This historically large spread should narrow as the odds are low that it will continue for months to come.

The billion-dollar question is this; which asset(s) will play the biggest game of catch-up? Are stocks overextended or has copper/yields declined way more than they should have?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.