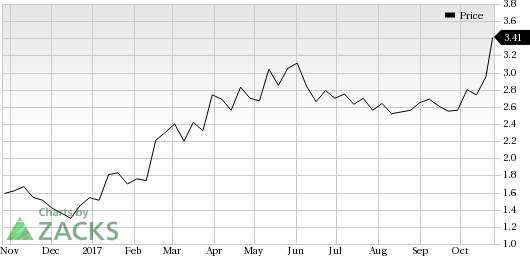

LightPath Technologies, Inc. (NASDAQ:LPTH) was a big mover last session, as the company saw its shares rise nearly 15% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This continues the recent uptrend for the company—as the stock is now up 39.8% in the past one-month time frame.

The company has seen no changes when it comes to estimate revision over the past few weeks, while the Zacks Consensus Estimate for the current quarter has also remained unchanged. The recent price action is encouraging though, so make sure to keep a close watch on this firm in the near future.

LightPath Technologies currently has a Zacks Rank #4 (Sell) while its Earnings ESP is 0.00%.

Investors interested in the Electronics - Miscellaneous Components industry may consider AAC Technologies Holdings Inc. (OTC:AACAY) , which has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is LPTH going up? Or down? Predict to see what others think:Up or Down

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

AAC Technologies Holdings Inc. (AACAY): Free Stock Analysis Report

LightPath Technologies, Inc. (LPTH): Free Stock Analysis Report

Original post

Zacks Investment Research

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.