The FSA released records of their LIBOR manipulation claim against Barclays. The full document is attached below. Some of the trader/submitter conversations are incredible - and it's quite amazing what people will say on recorded lines, e-mails, or text. No wonder it's going to cost Barclays half a billion to settle. Here is a sample:

FSA: - ... on 5 February 2008, Trader B (a US dollar Derivatives Trader) stated in a telephone conversation with Manager B that Barclays’ Submitter was submitting “the highest LIBOR of anybody […] He’s like, I think this is where it should be. I’m like, dude, you’re killing us.” Manager B instructed Trader B to: “just tell him to keep it, to put it low.” Trader B said that he had “begged” the Submitter to put in a low LIBOR submission and the Submitter had said he would “see what I can do.”

...

[another conversation] “I really need a very very low 3m fixing on Monday – preferably we get kicked out. We have about 80 yards [billion] fixing for the desk and each 0.1 [one basis point] lower in the fix is a huge help for us. So 4.90 or lower would be fantastic.”

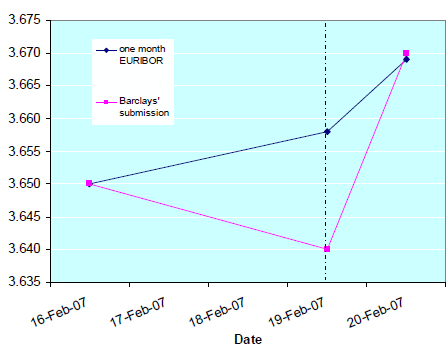

Here is an example of Barclays manipulation of EURIBOR in 2007. Hard to argue against this type of evidence.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.