Friday, October 19th, is the 25th anniversary of the stock market crash of 1987. I was a mere three weeks into my new job as research director for a group of market makers at the Chicago Board Options Exchange. It was a dramatic experience. Mrs. OldProf was visiting both to celebrate our anniversary and to look for an apartment in the city. We met friends, hit some shows, and dined at Al Capone's favorite restaurant. Great fun on Friday.

On Monday things looked a lot different. We decided to put the move from Wisconsin on hold for a little longer, not signing any leases just yet!

Fortunes were made and lost that day, sometimes the result of what seemed like very small decisions a few days earlier. Like everyone else who lived through those days I have quite a few stories. While those are interesting, I want to focus on the lessons that might be relevant for today's investors.

Causes of the Crash

In October of 1987 there was an explosive mixture of an over-valued stock market, rampant and ill-advised program trading, and extreme over-confidence on the part of many investors. A growing trade deficit and falling dollar caused many to believe that higher interest rates were necessary. The spark seemed to occur on Friday, October 16th, 1987, with the effects rippling around the world over the weekend. Mutual funds had large sell orders on the morning of the 19th, necessary to meet redemptions.

I am sure that the paragraph above will sound to some just like a description of current conditions. I wrote it with that in mind. I suspect that you will see more than one article pursuing that theme. It is true that some problems seem to persist for decades, or to re-emerge in different forms. The exact causes of the Crash are still being debated. The combination of my academic curiosity and personal stake inspired me to study the subject very carefully. Here is a brief summary of my conclusions.

Valuation

The stock market was wildly overvalued, even by the most bullish methods.

To avoid getting bogged down in the question of the best valuation measure, let's pick one and use it both for 1987 and for today. Those who are most concerned about current market valuation are very critical of using 12-month forward earnings and taking account of interest rates -- variously called the "Fed Model" or the equity risk premium. Today's forward earnings on the S&P 500 are about $108 so the earnings yield is about 7.6% compared to a ten-year Treasury note yield of 1.8% or an ERP of 5.6%.

Right before the Crash, the forward earnings were $22.45 for a forward yield of about 7.0%. The difference is that the ten-year yield was 9.42%, so the ERP was not a premium at all, but a negative 2.42%. Even if you aggressively believed that the earnings yield should be the same as the Treasury note, stocks were over-valued by 33%. The decline on the day of the crash was 22%. Inflation was running in the 4.5% range, but was moving significantly higher.

The valuation situation is not similar. If you think the market is overvalued now, it was awesomely overvalued then! (And please don't substitute what you think the CPI or interest rates should be. It is better to evaluate data than opinion).

Trading and Market Rules

In 1987 many big fund managers embraced a concept called "portfolio insurance." Simply stated, the idea was that you should hold a very aggressive allocation in stocks -- more than your normal risk tolerance would suggest. If the market started lower, you would then (and only then) sell short futures on the broad stock market. These short futures would hedge your position. If the market declined further, you would sell more futures. You did not want to hedge in advance, since it would be a drag on your performance.

The result was that the instant decline in stocks triggered the sale of index futures. The futures, which responded more quickly than the cash market, gapped lower. Arbitrageurs attempted to buy futures and sell stocks to profit from the spread. This pushed stocks even lower, causing another leg down in this deadly spiral.

While we still have program trading, the highly-publicized events of the last few years do not rival 1987 either in breadth or magnitude. The portfolio insurance concept has been abandoned. Various circuit breakers limit the possibility of a cascade of futures and stock trading. Electronic markets have improved liquidity. In 1987, the Nasdaq market was based on telephone calls and the market makers were not even answering! Options traders settled up at the end of the day with "outtrades" checked in the morning. In 1987 some traders dropped their cards on the floor and left the building. Some, who had escalated risks to their backers during the day, simply headed for O'Hare, spawning the term "airport play." Now the trades are electronically transmitted throughout the day, so backers and clearing firms always know what is happening.

Economic Situation

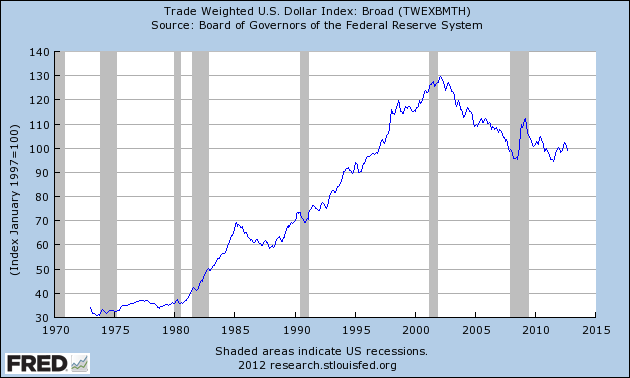

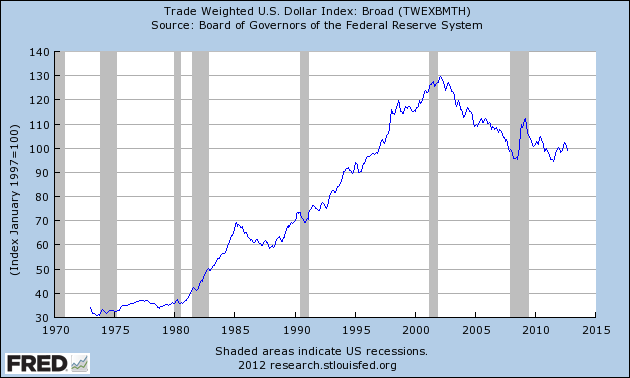

Most importantly, we should note that the 1987 crash was not associated with a recession, either before or after. Some have suggested that rhetoric about the weakening dollar was the proximate cause. The easiest way to evaluate this is by looking at a chart of the trade-weighted dollar. Look at the long-term trend as well as the specific time in 1987 and now.

The 1987 crash was not an economic phenomenon. We do not currently face similar risks.

The Real Lessons

Simply put, the crash destroyed objective analysis for years.

This most important lesson of the Crash is not commonly understood. For the next few years, any stock system, whether based on fundamentals, technicals, or a computer program, had an acid test:

Did it call the crash?

We saw dozens of pitches. No one even bothered with a method that did not include a successful "crash call." The event was so important, and had such a great impact on results, that you could not make a persuasive case for a system that did not have a "tweak" that would have predicted the crash.

Similarly, analysts who had given warnings were celebrated as heroes. This turned out to be fifteen minutes of fame for some.

This final lesson is probably the most important, and the most difficult to understand. Excessive emphasis on the "crash call" warped the thinking of portfolio managers and individual investors alike. The life-changing events from 25 years ago punished some of the smartest traders and rewarded some of the, ahem, least skilled who happened to have the right position for the wrong reason.

Those who took the wrong lessons from this got to double down in lost opportunity. They followed the wrong gurus and the wrong systems for many years thereafter. They never recovered.

2008 is an echo of 1987. Another generation of investors may be lost.

A Final Word

Can stocks decline from current levels? Of course, and for various reasons. A 2008-style decline came for reasons much different from 1987. We now know more about those risks as well, something that I track every week.

Markets can decline, but it will not be from a scenario like that of 1987.

On Monday things looked a lot different. We decided to put the move from Wisconsin on hold for a little longer, not signing any leases just yet!

Fortunes were made and lost that day, sometimes the result of what seemed like very small decisions a few days earlier. Like everyone else who lived through those days I have quite a few stories. While those are interesting, I want to focus on the lessons that might be relevant for today's investors.

Causes of the Crash

In October of 1987 there was an explosive mixture of an over-valued stock market, rampant and ill-advised program trading, and extreme over-confidence on the part of many investors. A growing trade deficit and falling dollar caused many to believe that higher interest rates were necessary. The spark seemed to occur on Friday, October 16th, 1987, with the effects rippling around the world over the weekend. Mutual funds had large sell orders on the morning of the 19th, necessary to meet redemptions.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

I am sure that the paragraph above will sound to some just like a description of current conditions. I wrote it with that in mind. I suspect that you will see more than one article pursuing that theme. It is true that some problems seem to persist for decades, or to re-emerge in different forms. The exact causes of the Crash are still being debated. The combination of my academic curiosity and personal stake inspired me to study the subject very carefully. Here is a brief summary of my conclusions.

Valuation

The stock market was wildly overvalued, even by the most bullish methods.

To avoid getting bogged down in the question of the best valuation measure, let's pick one and use it both for 1987 and for today. Those who are most concerned about current market valuation are very critical of using 12-month forward earnings and taking account of interest rates -- variously called the "Fed Model" or the equity risk premium. Today's forward earnings on the S&P 500 are about $108 so the earnings yield is about 7.6% compared to a ten-year Treasury note yield of 1.8% or an ERP of 5.6%.

Right before the Crash, the forward earnings were $22.45 for a forward yield of about 7.0%. The difference is that the ten-year yield was 9.42%, so the ERP was not a premium at all, but a negative 2.42%. Even if you aggressively believed that the earnings yield should be the same as the Treasury note, stocks were over-valued by 33%. The decline on the day of the crash was 22%. Inflation was running in the 4.5% range, but was moving significantly higher.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The valuation situation is not similar. If you think the market is overvalued now, it was awesomely overvalued then! (And please don't substitute what you think the CPI or interest rates should be. It is better to evaluate data than opinion).

Trading and Market Rules

In 1987 many big fund managers embraced a concept called "portfolio insurance." Simply stated, the idea was that you should hold a very aggressive allocation in stocks -- more than your normal risk tolerance would suggest. If the market started lower, you would then (and only then) sell short futures on the broad stock market. These short futures would hedge your position. If the market declined further, you would sell more futures. You did not want to hedge in advance, since it would be a drag on your performance.

The result was that the instant decline in stocks triggered the sale of index futures. The futures, which responded more quickly than the cash market, gapped lower. Arbitrageurs attempted to buy futures and sell stocks to profit from the spread. This pushed stocks even lower, causing another leg down in this deadly spiral.

While we still have program trading, the highly-publicized events of the last few years do not rival 1987 either in breadth or magnitude. The portfolio insurance concept has been abandoned. Various circuit breakers limit the possibility of a cascade of futures and stock trading. Electronic markets have improved liquidity. In 1987, the Nasdaq market was based on telephone calls and the market makers were not even answering! Options traders settled up at the end of the day with "outtrades" checked in the morning. In 1987 some traders dropped their cards on the floor and left the building. Some, who had escalated risks to their backers during the day, simply headed for O'Hare, spawning the term "airport play." Now the trades are electronically transmitted throughout the day, so backers and clearing firms always know what is happening.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Economic Situation

Most importantly, we should note that the 1987 crash was not associated with a recession, either before or after. Some have suggested that rhetoric about the weakening dollar was the proximate cause. The easiest way to evaluate this is by looking at a chart of the trade-weighted dollar. Look at the long-term trend as well as the specific time in 1987 and now.

The 1987 crash was not an economic phenomenon. We do not currently face similar risks.

The Real Lessons

- A better understanding of risk and reward. Before the crash the individual investor was a happy seller of naked puts. The "crash" issue of Barron's had classified ads for trading systems the showed you how to print money. People sold puts based not on how much risk they could afford, but how much money they wanted to make. Options clearing firms evaluated positions based upon a three-standard deviation move -- a real extreme. This was a big lesson in the fat tails of the stock return distribution. The aftermath was the greatest opportunity in history to sell put premium, something that I pointed out to my new boss. The rules had changed! Even professional traders were on a short leash for put selling.

- The importance of margin. Those who had accounts on margin of any sort suffered the greatest cost. Positions were ruthlessly liquidated to satisfy the margin call. This included futures positions and option contracts that were trading far from anything resembling fair value. Taking on excessive margin risk proved to be a big mistake.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

And the Most Important? Simply put, the crash destroyed objective analysis for years.

This most important lesson of the Crash is not commonly understood. For the next few years, any stock system, whether based on fundamentals, technicals, or a computer program, had an acid test:

Did it call the crash?

We saw dozens of pitches. No one even bothered with a method that did not include a successful "crash call." The event was so important, and had such a great impact on results, that you could not make a persuasive case for a system that did not have a "tweak" that would have predicted the crash.

Similarly, analysts who had given warnings were celebrated as heroes. This turned out to be fifteen minutes of fame for some.

This final lesson is probably the most important, and the most difficult to understand. Excessive emphasis on the "crash call" warped the thinking of portfolio managers and individual investors alike. The life-changing events from 25 years ago punished some of the smartest traders and rewarded some of the, ahem, least skilled who happened to have the right position for the wrong reason.

Those who took the wrong lessons from this got to double down in lost opportunity. They followed the wrong gurus and the wrong systems for many years thereafter. They never recovered.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

2008 is an echo of 1987. Another generation of investors may be lost.

A Final Word

Can stocks decline from current levels? Of course, and for various reasons. A 2008-style decline came for reasons much different from 1987. We now know more about those risks as well, something that I track every week.

Markets can decline, but it will not be from a scenario like that of 1987.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI