Learning Technologies Group PLC (LON:LTGL) released another strong set of results and trading post the year end is ahead of management expectations. The outlook is supported by a successful “co-ordinated selling” strategy, which has been driving cross-sales across the business units, creating sector-leading margins, and the order book is healthy. LTG is comfortably on target to double run rate revenues to £100m and achieve run rate EBIT of at least £25m by the end of 2020. While the shares look punchy on c 34x our FY19e EPS, the business is attractively positioned in an industry growing in double figures and we note that potential high-teen growth opportunities are hard to find across the broader market.

FY17 results: Underlying organic growth was 20%

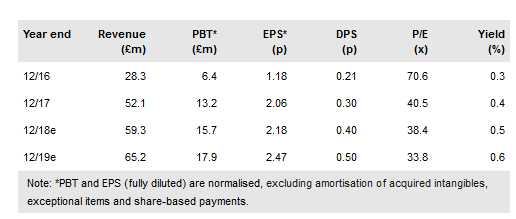

Key FY17 numbers were in line with the January update. Group revenue grew by 84% to £52.1m, including 36% organic growth (35% on a constant currency basis). After stripping out the lumpy CSL contract, underlying organic growth was 20%. Recurring revenues were 39% of the total, or c 42% on a pro forma basis. Adjusted EBIT more than doubled to £14.0m, implying that H2 margins were 32.4% against 19.2% in H1, reflecting H2 weighting and synergies generated from NetDimensions. NetDimensions has comfortably met its $8m cost savings and generated a stronger than anticipated performance in Q4. LTG ended FY17 with £1.0m of net cash (£7.9m ahead of our forecasts prior to the January update).

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.