Trump calls for Intel CEO’s resignation, stock falls

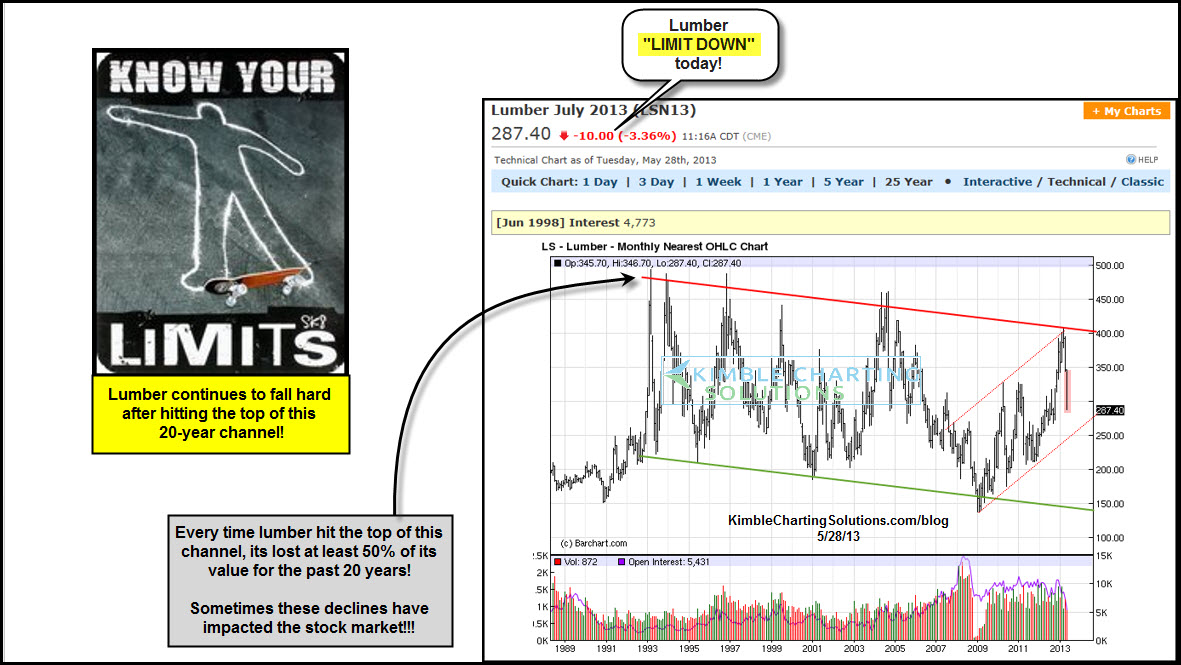

The Power of the Pattern reflected that a key economic asset, Lumber, could fall 50% in value back on 3/18, due to 20-year channel resistance and 75% bulls. (see here)

Lumber was trading at $385 at the time, while today Lumber is limit down trading at $287, losing 25% of its value in 70 days!

The above chart reflects that 100% of the time that Lumber hit the top of its trading channel, it has fallen at least 50% in value, over and over for the past 20 years. I doubt that many of you trade Lumber and many of you might be saying,"why should I care about Lumber, I don't own it."

Let's look at Lumber a little more closely: The bottom of the channel was hit in 1995, 2001 and 2009, not bad times to be looking to buy stocks at low prices. The last serious decline by Lumber took place in early 2011. What did the S&P 500 do after this Lumber decline? SPY declined 17%, peaking in May of 2011.

Lumber is not the "Holy Grail" of stock market indicators, yet oftentimes it has paid to respect it at the top and bottom of this 20-year channel and its message for the stock market.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.