Good day traders!

Today's focus is on USD/JPY and its short-term Elliott wave pattern. Let's dig in!

USDJPY is moving down for the last few days in shape of a contracting wedge, which can be a leading diagonal in wave A) as part of a new big three wave structure, this time to a bearish side. If that's the case, then market may not give us much clarity in days ahead, but it may turn up from 112.00 area.

USD/JPY, 1H

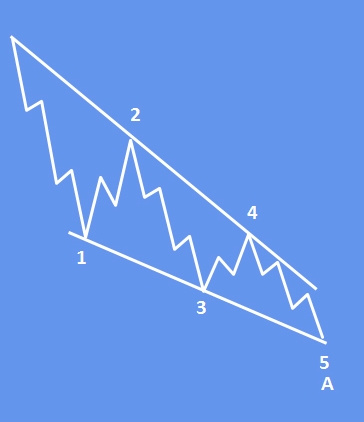

When diagonal triangles occur in the fifth or C wave position, they take the 3-3-3-3-3 shape that Elliott described. However, it has recently come to light that a variation on this pattern occasionally appears in the first wave position of impulses and in the A wave position of zigzags. The characteristic overlapping of waves one and four and the convergence of boundary lines into a wedge shape remain as in the ending diagonal triangle. However, the subdivisions are different, tracing out a 5-3-5-3-5 pattern.

- structure is 5-3-5-3-5

- a wedge shape within two converging lines

- wave 4 must trade into a territory of a wave 1

- appears in the wave one position in an impulse, in the A wave position of A-B-C

Example of an EW leading diagonal:

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.