S&P 500 Non-Commercial Positions:

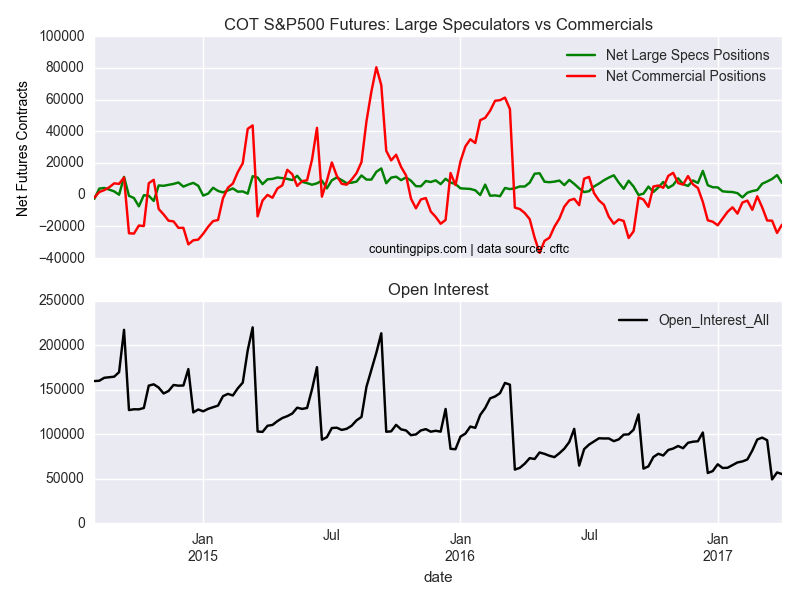

Large speculators and traders reduced their bullish net positions in the S&P500 stock futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 futures, traded by large speculators and hedge funds, totaled a net position of 7,382 contracts in the data reported through April 4th. This was a weekly decline of -4,988 contracts from the previous week which had a total of 12,370 net contracts.

Large speculative positions had been on a seven week roll that had pushed bullish net positions to the highest level since mid-December before last week’s shortfall. Last week’s decline (-4,988 contracts) marks the largest one week fall since December 20th when net positions dropped by -9,065 contracts.

S&P500 Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -18,859 contracts last week. This is a weekly change of 5,222 contracts from the total net of -24,081 contracts reported the previous week.

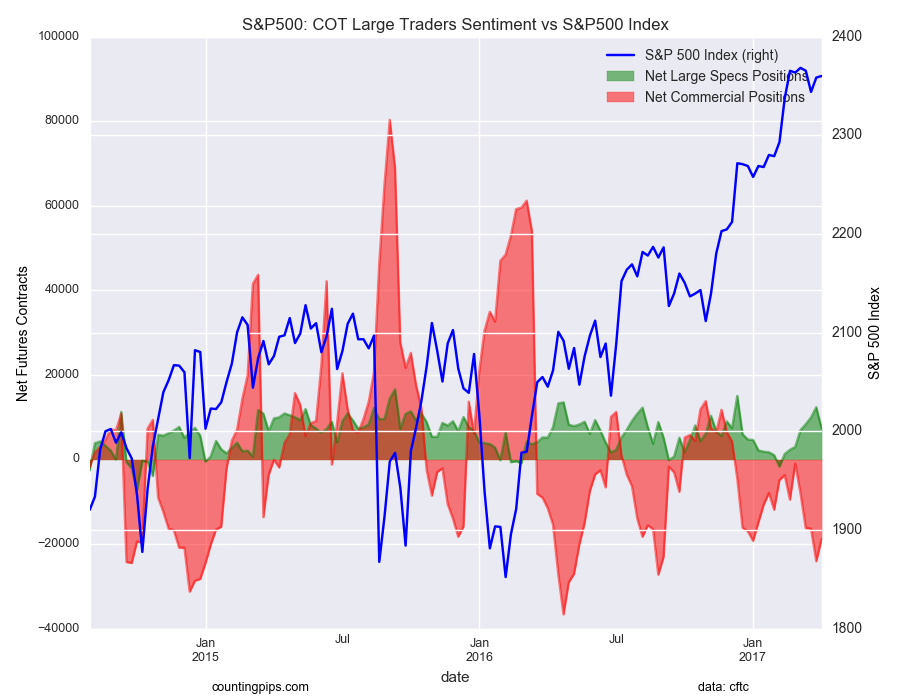

S&P500 Stock Market Index:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the S&P500 index closed at approximately 2360.15 which was a gain of 1.58 from the previous close of 2358.57, according to market data.