Investing.com’s stocks of the week

Talking Points

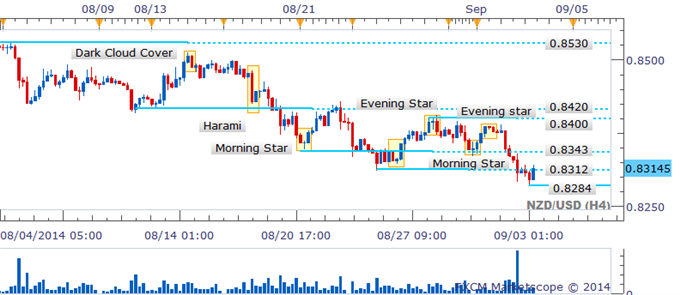

- NZD/USD Technical Strategy: Sidelines Preferred

- Shooting Star Candlestick Pattern Delivers Declines

- Awaiting Clearance Of 0.8260 To Open 0.8060

NZD/USD is left at a critical juncture near the 0.8260 floor with a Shooting Star candlestick in its wake. A daily close under the critical floor would be required to open the next leg lower towards the pair’s 2014 lows near 0.8060. At this stage an absence of key reversal patterns casts doubt on the potential for a corrective bounce.

NZD/USD: Assault On 0.8400 Following Shooting Star Formation

An Evening Star pattern offered an early warning of a pullback in intraday trade for the Kiwi. The pair is now hinting at a bounce over the session ahead as a Bullish Engulfing pattern emerges near the session lows. If confirmed by a successive up period it could pave the way for a retest of former support-turned-resistance near 0.8343. Given the context afforded by the daily, selling into rallies is preferred.

NZD/USD: Eyes On H4 For Intraday Turning Point Signals

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.