Talking Points:

NZD/USD Technical Strategy:Flat

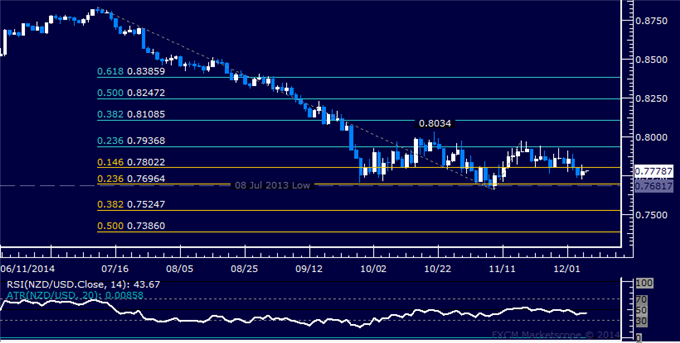

- Support: 0.7682, 0.7525, 0.7386

- Resistance:0.7802, 0.7937, 0.8034

The New Zealand Dollar paused to consolidate after breaking below the bottom of a range containing prices since mid-November. A daily close below the 0.7682-96 area marked by the July 2013 bottom and the 23.6% Fibonacci expansion exposesthe 38.2% level at 0.7525.Alternatively, a turn above the14.6% Fib at 0.7802opens the door for a test of the 23.6% Fib retracement at 0.7937.

A short trade looks attractive from a purely technical perspective but we will opt against establishing the position. The approaching US Employment report represents an important inflection point for risk appetite and may meaningfully alter positioning for the sentiment-sensitive New Zealand unit. As such, we will opt to wait for event risk to pass before committing to a directional bias.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.