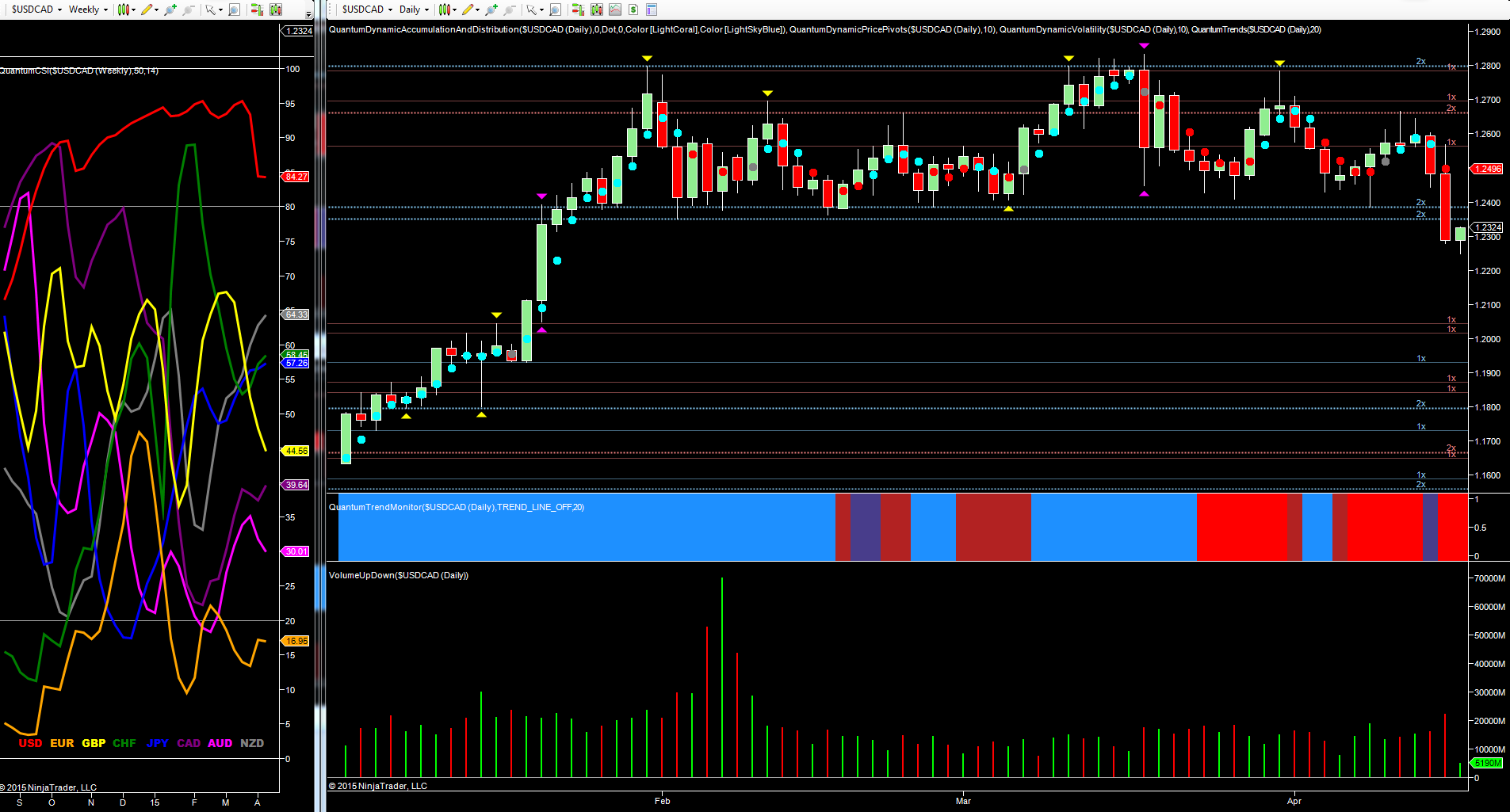

An extremely significant day for the USD/CAD yesterday, which finally ended its extended phase of congestion, a period of price action I have referred to before as a barometer for the currency of first reserve and also oil. (here) To the upside, the ceiling of resistance was defined by the 1.2800 region which was tested on several occasions, with an equally strong platform of support in the 1.2350 area. This was finally breached with yesterday’s wide spread down candle, closing at 1.2288 and duly confirmed with a dramatic increase in volume. As always with a commodity currency, the twin effects of weakness in the US dollar and strength in the associated commodity—in this case oil—combined to drive momentum into the currency pair.

In early European trading, the pair have moved marginally higher off the lows of the session to trade at 1.2316 at the time of writing, with the longer term outlook now turning very bearish. This is also reflected on the weekly currency strength indicator to the left of the chart with the red line, the US dollar, now starting to roll over and away from the heavily overbought region, and the Canadian dollar, the purple line, moving just as firmly away from the oversold region in this timeframe.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.