Morgan Stanley identifies next wave of AI-linked "alpha"

This week, KEFI Minerals PLC (LON:KEFI) announced that it had signed an agreement with Oryx Petroleum Corporation Limited (TO:OXC) for US$135m of lease funding for Tulu Kapi. As a result, Oryx will assume c 70% of the project’s on-site capex requirements in a form of build, own, operate and transfer (BOOT) arrangement. Following full repayment of the lease, ownership will revert to KEFI.

2017 KEFI mine plan

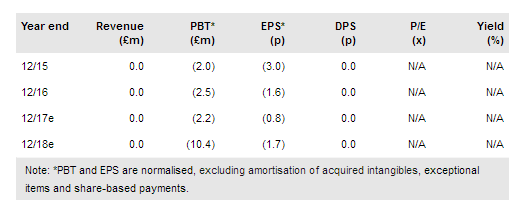

As a consequence of its funding announcement, KEFI has also updated its schedule of required capital investment, which has been increased by the extra financing costs required for the Oryx project funding structure (see Exhibit 3). It has also placed emphasis on its previously reported plan (outlined at the time of the release of its DFS update in May) to process mined ore at rates 10% higher than nameplate. In summary, aggregate production, throughput, etc are the same over the 10-year mine life, but we now recognise that production has been brought forward by c one year, such that mining starts six months ahead of processing in late FY19. Operating costs are selectively lower than those previously published (Exhibit 2).

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI