Ever since the U.S. economy started pulling itself out of the earnings recession last year, high yield bonds have been the fixed income asset class of choice.

Since credit spreads peaked in February of last year, the SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK) has returned over 27%, almost on pace with the 31% return of the S&P 500 during the same time frame.

But this might be a classic case of investors looking to jump into a recently successful asset class only after the easy gains have already been had. Junk bonds looked like they might be in some trouble heading into 2015. The energy group was the big offender as oil prices plunged and companies in the sector struggled to remain viable. Since then, energy prices normalized, the economy strengthened and high yield investors were richly rewarded.

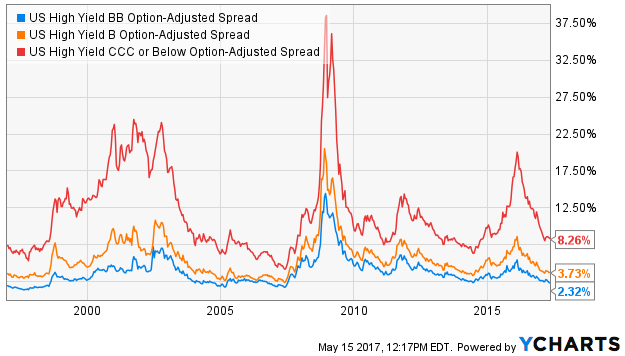

During the recovery, spreads shrunk by 60% across all non-investment grade ratings.

Since they’re now back at historically normal levels, investors looking to jump in now should probably temper their expectations. High yield bonds as an asset class have returned about 8% annually over the long-term but yields right now are generally in the 5-6% range, some of the lowest rates they’ve paid in at least the last two decades.

Given the strength of the economy right now, it’s probably a reasonable expectation that high yield bonds will continue to perform fairly well, but it’s also prudent to limit risk as well. That’s why I’m a fan of JNK’s counterpart, the SPDR Barclays Short Term High Yield Bond (NYSE:SJNK).

The two funds have the same general credit quality profile (about 80% of assets in BB- and B-rated bonds with the remainder in CCC and below) but SJNK stays way on the short end of the curve. The fund maintains an average maturity of just a little over three years and a duration of only two years. With a yield of about 5.8%, that’s a pretty strong yield-to-risk tradeoff in the current fixed income environment. Interestingly, the current yield on SJNK is almost identical to that of JNK (5.8% vs. 5.9%). I’d expect the two yields to diverge to their normal difference of around 50-75 basis points over time, but, for now, the short-term end of the curve delivers a much better risk/return profile.

With 10-year Treasuries yielding around 2.3% and equity dividend ETFs paying about 3%, short-term high yield bonds and their 5%+ yields present an interesting option for yield seekers. There’s still a fair amount of risk involved if the economy shows signs of slowing but that doesn’t look like it’s in the offing anytime in the near future. High yield bond ETFs still look attractive but make sure to stay on the short end of the curve.

The SPDR Bloomberg Barclays Short-Term High Yield Bond ETF was unchanged in premarket trading Tuesday. Year-to-date, SJNK has gained 1.30%, versus a 7.50% rise in the benchmark S&P 500 index during the same period.

SJNK currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #4 of 36 ETFs in the High Yield Bond ETFs category.