Junk Bonds have been quality leading indicator for the Risk On/Risk Off trade since the late 1990’s. I love the messages coming from junk bonds, over the past 20-years.

Junk Bond ETF’s started turning soft in 2014 and the broad markets in the states make little upward progress after that.

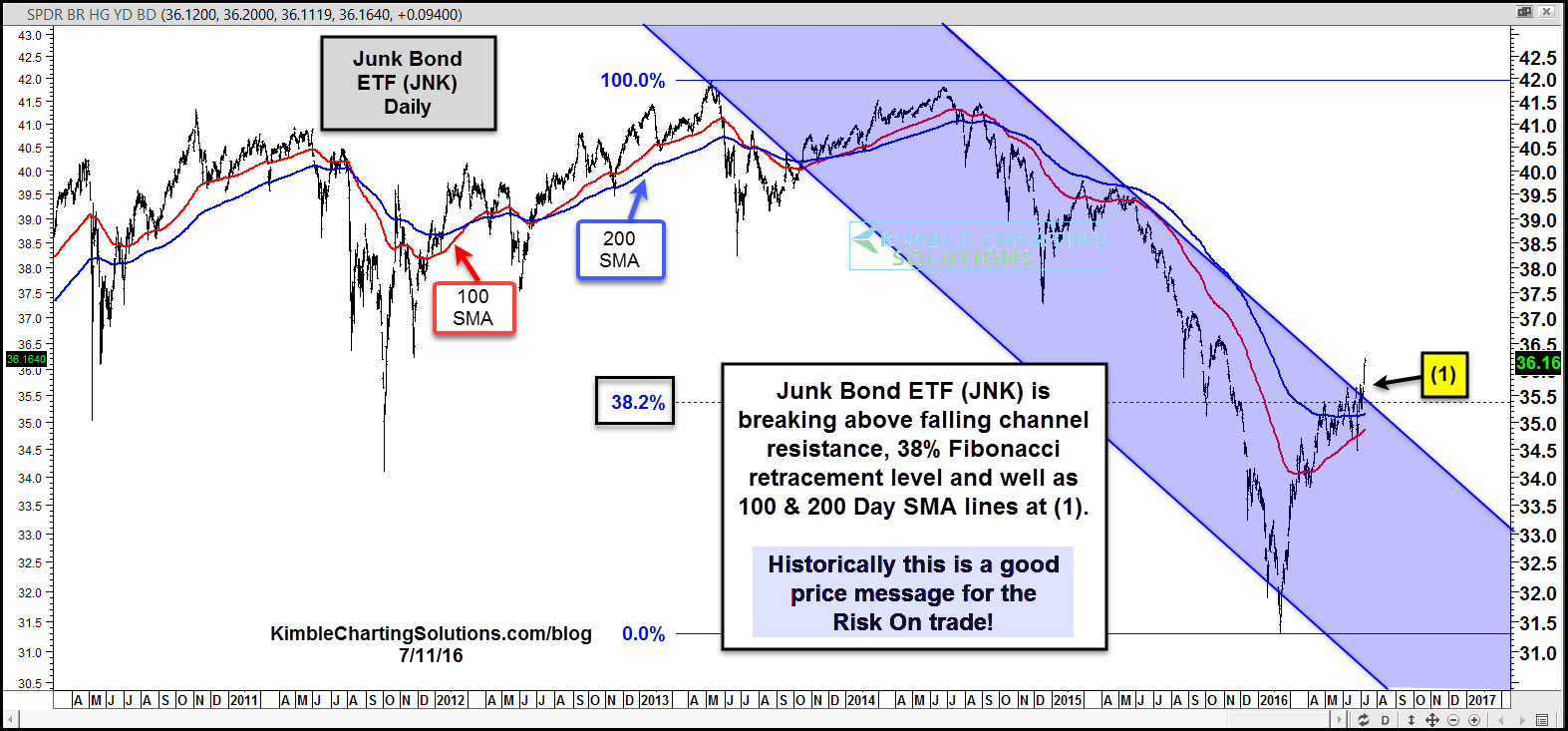

Below looks at an update on Junk Bond ETF (NYSE:JNK).

JNK in the chart above, is breaking above its two year falling channel and is now above both the 100 and 200 day moving average lines at (1). This is the first time in over 2-years, that JNK hits 100 and 200 day moving average lines.

With the S&P working on hitting all-time highs, this push above resistance and long-term moving averages, sends an encouraging message to the risk on trade.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI