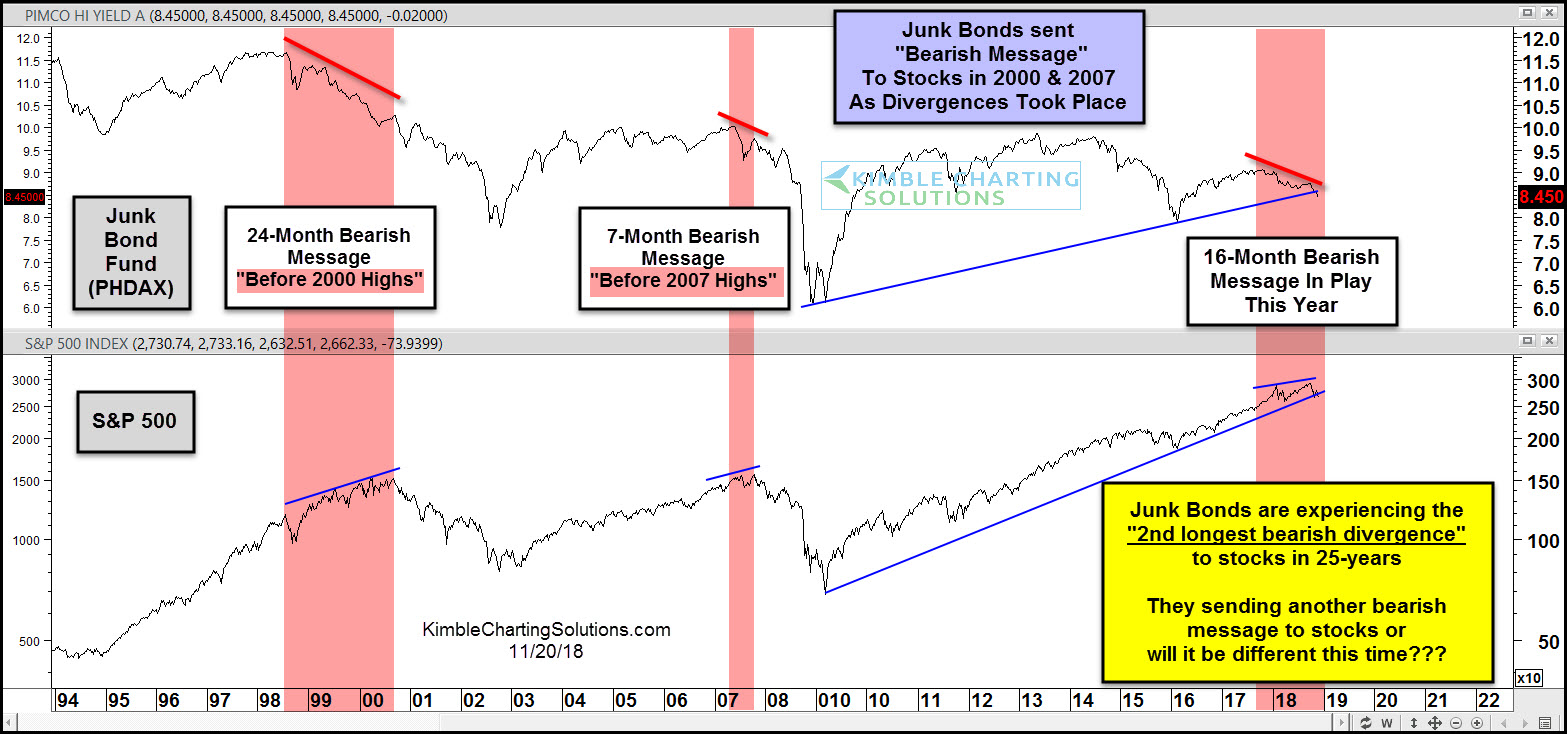

This chart looks at junk-bond fund PHDAX and the S&P 500 over the past 25 years. Junk bonds sent bearish messages before stocks peaked in 2000 and 2007. Bearish divergences took place for 24 months in 2000 and for 7 months in 2007, prior to stocks peaking and turning much lower.

Junk bonds have been sending a bearish message to stocks for the past 16 months, as another bearish divergence has been taking place.

Junk bonds and the S&P 500 are currently testing 9-year rising support. If both break below 9-year support, they would be suggesting that a long-term low in stocks is not in play.

Are junk bonds sending an important message as they did in 2000 and 2007 or will it be different this time?

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI