TSMC Q2 profit soars 61% to record high; sees AI demand offsetting forex headwinds

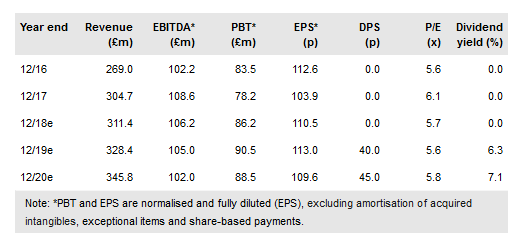

The UK government has raised remote gaming duty (RGD) from 15% to 21%. This is 1% higher than expected by the market and we now include a c £12m annual impact on group EBITDA into our forecasts for Jackpotjoy (LON:JPJ). While regulatory pressures are likely to remain a feature of the UK gaming sector, JPJ should benefit from its market leading position and we anticipate annual operating cash flow of over £90m. The stock has fallen c 40% since June and now trades at 7.9x EV/EBITDA, 5.6x P/E and 15.5% free cash flow yield for FY19e.

RGD increase to begin October 2019

The UK government’s budget has provided long-awaited clarity on remote gaming duty, which will rise from 15% to 21%. This compares to the 20% that was widely expected, but is a better result than recent rumours of 25%. The increased duties will affect all online gaming operators (not sports) in the UK from October 2019 (rather than April), but at least the sector now has a degree of certainty. Other ongoing regulatory pressures include social responsibility, anti-money laundering, source of funds etc. All this is likely to lead to a continued market shake out, with dominant players likely to benefit. We note that as the largest online bingo-led operator in the UK, JPJ is particularly well positioned.

To read the entire report Please click on the pdf File Below..

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI