John Laing Group Plc (LON:JLG) pre-close update confirms the strong level of activity in the business in FY18. JLG will provide guidance on the level of realisations and investment commitments expected for FY19 at its results (due March) but we believe the outlook for next year and beyond appears encouraging based on the investment pipeline and global demand for infrastructure. JLG’s discount to its peer group does not reflect its proven track record or the prospects for further growth.

High levels of investment activity

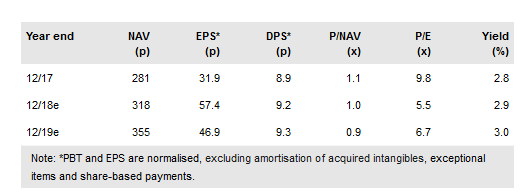

JLG revealed that investment commitments for the year so far have amounted to £267m, with up to another £30m possible before the year end (guidance £250m). Total realisations completed in 2018 amounted to £241.5m (guidance £250m) with a further £54.5m (Manchester Waste TPS) agreed but not yet completed. The special component of the DPS will be based on the realisation figure of £241.5m. According to JLG, with the exception of the sale of IEP Phase 1 completed earlier in the year at above book valuation, the investment portfolio has performed ‘in line with expectations’. At 30 November, the IAS19 pension surplus had fallen to £6m from £24m at the end of June.

To read the entire report Please click on the pdf File Below..

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI