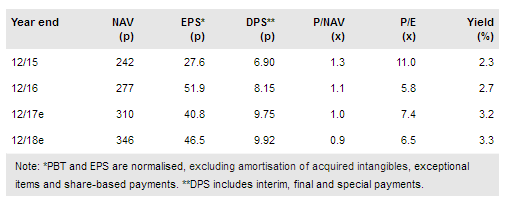

John Laing Group's (LON:JLG) pre-close update did not contain any significant surprises. Investment commitments and realisations are on track to meet FY17 targets, and the outlook for both the primary and secondary investment markets remains strong. We maintain our expectation of continued strong growth in the NAV in FY17 (to 310p – revised from 308p previously) and see upside for the shares based on our estimates.

Progress in line with FY17 guidance

JLG’s pre-close update was in line with both our expectations and its own targets for FY17. JLG has made investment commitments so far in 2017 of £111m and reiterated that it expects total investment commitments for FY17 to be c £200m (Edison FY17e: £200m). Realisations so far have totalled £151m, including the A1 motorway in Poland (£120.4m) and the M6 road in Hungary (£22.7m). The aggregate prices achieved for the disposals are said to be in line with portfolio aggregate values and JLG retains its guidance of £200m (Edison FY17e: £200m). The investment portfolio is performing in line with management expectations and JLG achieved commercial acceptance for the New Royal Adelaide Hospital in June and will include it in its secondary portfolio as at the end of June. Talks with the Greater Manchester Waste Disposal authority regarding the future of the Manchester Waste project, where JLG has two separate but contractually linked projects (valued at c £94m), are continuing.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI