Yesterday the U.S. Labor Department reported weekly jobless claims fell 42,000 to 338,000. According to a Reuters article, Moody's Analytics' analyst Ryan Sweet said, "The underlying trend remains favorable. We will be able to muster stronger job growth in 2014." On the surface it does appear the job market is improving.

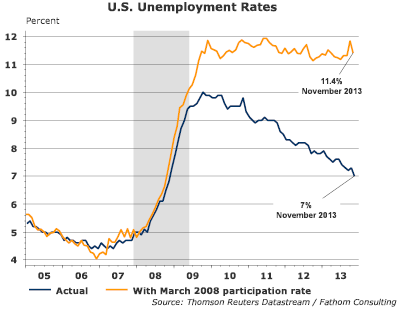

Several weeks ago the bureau of labor statistics reported the unemployment rate fell to 7% from the previous months rate of 7.3%. Although the participation rate improved slightly to 63% the rate remains below the pre-recession rate of 66%. If the participation rate equaled the pre-recession level, the unemployment rate would total 11.4% as detailed in the below chart. This is a rate that is not much better than at the end of the recession. This higher unemployment rate is the result of including an additional 7 million individuals in the labor force at the higher participation rate.

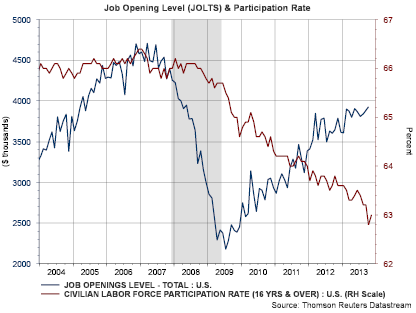

On the other hand, the December Job Openings and Labor Survey (JOLTS) release shows there were nearly 4 million job openings at the end of October. This is nearly double the openings at the end of the recession. The JOLTS report shows job openings continue to increase at a steady rate. The individual groups having the most difficulty finding a job are teenagers (20.8% unemployment rate) and those individuals that have less than a high school diploma (10.8% unemployment rate).

With the increased number of job openings, further improvement in the level of employment may occur into 2014. This could serve as a positive in a number of ways, i.e., more consumers, less government outlays, etc.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.