The markets fell yesterday despite the Fed pumping over $5 billion into the system. The primary reason is that the Fed is once again talking about tapering QE. There’s also the uncertainty of who the next Fed Chairman will be (Larry Summers’ odds of filling the roll can be correlated to the dips in the market as Summers has been critical of QE in the past).

Stocks are on the edge of a small cliff. It we take it out we could go to 1650 in a heartbeat. And if we take out 1625, then look out, we’ll likely wipe out several months of gains in a short period.

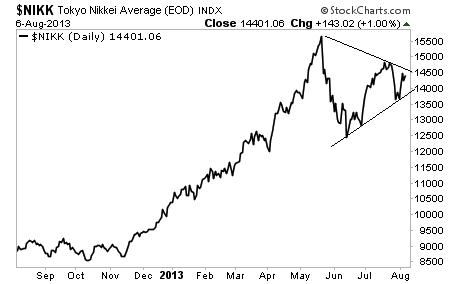

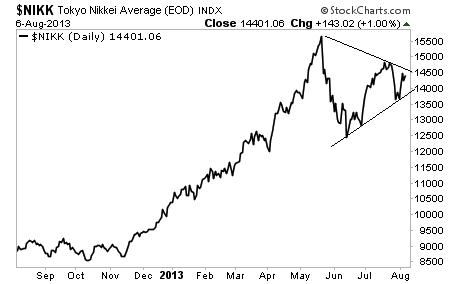

Speaking of which, the Nikkei has formed a triangle pattern. Watch this formation closely. Japan is leading the US as far as markets are concerned. A breakdown here would signal a major correction in US stocks.

In the US, the Fed continues to argue that money printing and QE can generate growth. There is literally no evidence of this in history. Japan and the UK have both engaged in massive QE programs to little or no effect.

However, the Fed is terrified of losing control of the system, so it wants to continue doing anything no matter how futile in order to maintain the appearance of confidence. God forbid anyone figures out that the emperor has no clothes.

Folks, there is no other way to put this… the markets are in a massive bubble. And when it bursts, things will get ugly very FAST.

Stocks are on the edge of a small cliff. It we take it out we could go to 1650 in a heartbeat. And if we take out 1625, then look out, we’ll likely wipe out several months of gains in a short period.

Speaking of which, the Nikkei has formed a triangle pattern. Watch this formation closely. Japan is leading the US as far as markets are concerned. A breakdown here would signal a major correction in US stocks.

In the US, the Fed continues to argue that money printing and QE can generate growth. There is literally no evidence of this in history. Japan and the UK have both engaged in massive QE programs to little or no effect.

However, the Fed is terrified of losing control of the system, so it wants to continue doing anything no matter how futile in order to maintain the appearance of confidence. God forbid anyone figures out that the emperor has no clothes.

Folks, there is no other way to put this… the markets are in a massive bubble. And when it bursts, things will get ugly very FAST.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI