I last wrote about Japan's Nikkei E-mini Futures Index in my post of December 26, 2012.

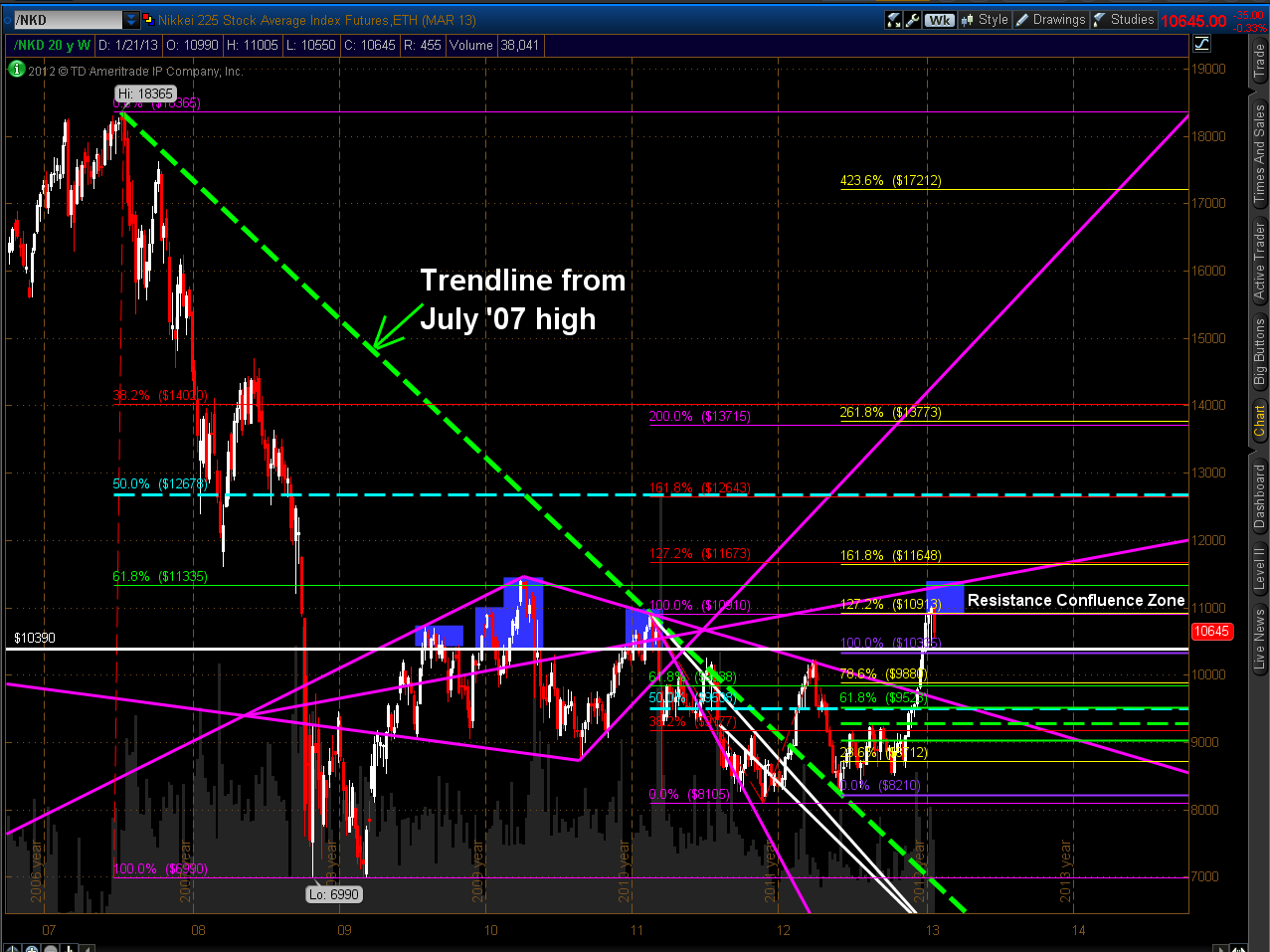

Price continued to rally and, subsequently, reached the confluence resistance zone at 11000 last week, where it was rejected on the first attempt to push above, as shown on the Weekly chart below.

We'll see whether their Central Bank's/government's aggressive asset purchase/fiscal program (in line with their 2% inflation target) continues to produce the same kind of upward momentum that it's seen since the December lows, and for how long. In any event, we may see choppy (and potentially volatile) movement in between 11300 and 10390, until price breaks and holds convincingly above or below those levels.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.